This post may contain affiliate links. See my disclaimer for more information.

Welcome to the eighth net worth report here at NMI!

March was a somewhat uneventful month. While stocks seemed to shift from wild gains to harrowing losses daily, overall, my balances remained pretty much unchanged. Cryptos, on the other hand, had a really volatile month, as you’ll see below.

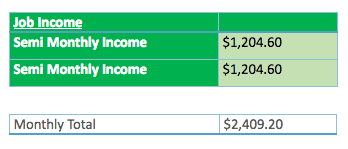

For those new to my net worth reports, I’d like to give you a few minor details. I get paid semi-monthly, which means I get paid on the 15th and the last day of the month.

Sometimes my money isn’t made available to me until two or three days after the month has already changed, so in order to ensure the most accurate net worth reports, I will always include both incomes. As such, my reports will be made available on the third or fourth day of the following month, possibly a few days after.

In rare circumstances in which I fail to get paid on time, I will either wait until that money is made available to report or I will include it in the following month’s net worth report.

You can find the latest and/or past reports here.

These figures are accurate as of the end of the day, April 4th.

MY INCOME

JOB INCOME

March was a little slow at work, but things picked up towards the end and I fortunately did get both of my paychecks.

SIDE INCOME

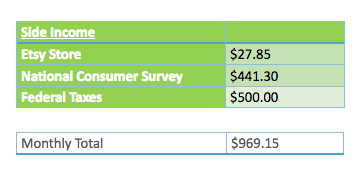

For the second month in a row, I have some additional side income to report! I’m trying to get this to be a regular thing, even if it’s just an extra $50 or $100 a month.

I was able to save a decent bit more this month because I received my state tax refund, a total of $500.00 – a nice little chunk, which went right into my savings.

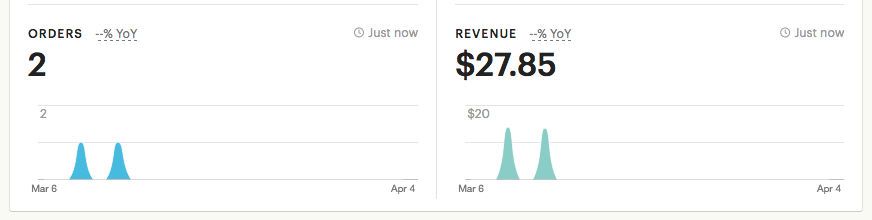

I also have some kinda exciting news: my Etsy store had two sales in March!

I know it’s not a lot, but considering my store’s only been open for about a month, it’s nice to know that people are interested in it. It also makes me excited because there’s the real potential that this could end up being a profitable side hustle for me. It’s not exactly passive income, but any extra money I can make and put towards my investments is worth getting.

I received another good chunk o’ change this month because of the survey and offers program I did for Reward Zone USA I wrote about a few days ago. If you missed that post, I’ll fill you in now. All I had to do was complete a survey, sign up for a handful (about 10) of offers from various partners, submit some paperwork and boom – I was mailed a $450.00 gift card! That was awesome and a much needed bonus.

I’m also looking into another side hustle I heard about awhile ago: picking up trash. There’s this guy who wrote a book about how you can make between $50,000.00 to $100,000.00 a year picking up trash and debris in parking lots and other areas for businesses. His book walks you through everything, from getting clients, figuring out how much to charge – he even gives template forms so you can bill clients.

This actually sounds like this could be a good side job for me. I’m passionate about environmental clean-up – I’ve turned my whole family into fervent recyclers. While the book itself is pretty expensive, it seems a small price to pay for possibly improving my life, right? I think I may just bite the bullet and buy it just bought it.

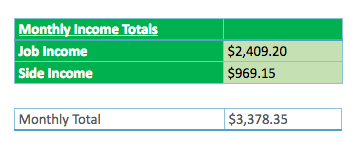

Overall, it was a good month income-wise. Between the RewardZone bonus and my tax return, it pushed my income up by quite a bit this month!

TOTAL INCOME

MY ASSETS

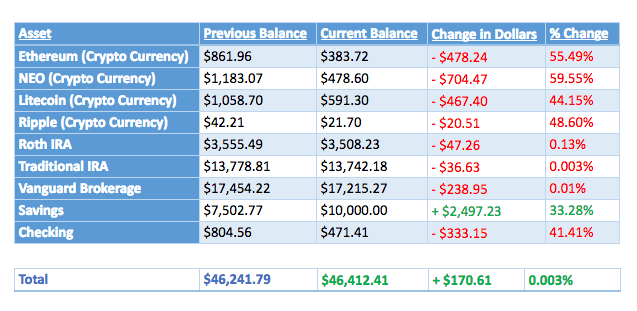

I decided I’d finally make like the other personal finance bloggers and include the percent change between this month and last month in my figures.

SAVINGS

With the receiving of my state taxes, I was able to save a little more this month. I’m proud to announce that I finally reached my $10,000.00 savings goal! I feel like that’s a good amount to have in case of an emergency, and enough that if there’s a big crash, I’ll be able to invest some.

I have $7,500.00 in a money market account and $2,500.00 in my regular savings account. Right now they’re both earning a tiny amount of interest – I’m interested in putting that money into a higher interest account, but I need to do some research first.

INVESTMENTS

As you can see from the table below, cryptos were hit hard this past month, with most going down about 50% or so.

My stocks fared much better, with there being relatively no change between last month and this month. That seems about right because lately, it seems that every other day is bouncing between super high and super low days.

Remember, when it comes to cryptos, never part with more money than you’re willing to lose! I’ve learned that the hard way!

Here’s a link to my article on cryptocurrency that every beginner should check out before jumping in.

*I decided to try an experiment in which I purchased 43 different cryptocurrencies (worth about $900.00 total) in the beginning of 2018 with the intent of holding onto them for one full year. You can check out the initial post here. I will be posting updates to that portfolio around the 15th of each month. I’ve decided to separate that portfolio from my net worth portfolio as it’s an experiment, so you won’t see the balance of that in these monthly reports.

MY LIABILITIES

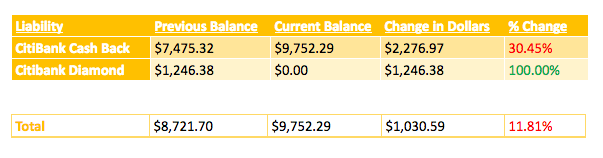

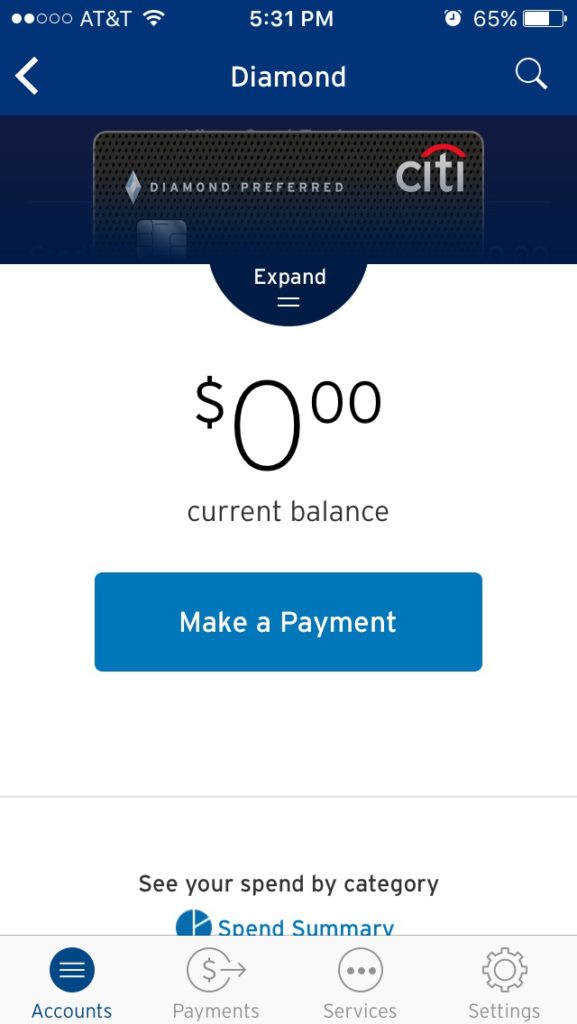

My regular Citibank Card balance keeps going up quickly, most recently because I’ve been paying rent with it as I’ve been getting paid late, but I am happy to announce that I completely paid off my second Citibank credit card!

Last month, the statement balance was $1,246.38. I made a $25.00 payment in early March, leaving a balance of $1,221.38, which I then paid off completely at the end of the month. Even though this card has no interest until August, I think I’m going to avoid using it so I can just have one single card I’m using for every single purchase. I think I tend to overspend when I use multiple cards.

Because my savings is now “full”, I’m going to try to really focus on paying down my debt and save maybe just 5% to 10% of my income each month (it’ll probably be more). I want to keep my savings going but I need to chip away at that debt – it’s dragging my net worth down. Because I have a decent bit of debt, the more I pay off, the higher my net worth goes. I always forget that.

I really recommend automating all of your bills, especially if they allow you to pay with a credit card. You set it up once and you don’t have to worry again. The only ones I don’t automate are accounts that need a checking account – you want to be sure the money is in there before it gets debited.

MY NET WORTH

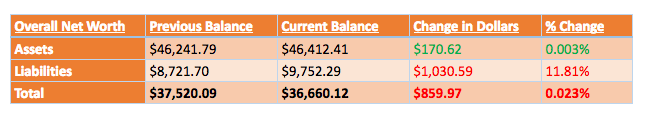

A decrease of – $859.97

Dang. It’s my first negative month since I’ve been tracking my net worth.

It’s pretty much all due to the crappy month we had last month for stocks, which still has me down by over $1,000.00, and the crappy month we had this month for crypto, which has me down over $1,500.00. Combined together, it was bound to finally start weighing me down. I’m not worried about it though. Being down by not even 2.5% isn’t too bad really, and the next paycheck I get will be going towards debt which will bring my net worth up, most likely pushing it higher than it’s ever been.

We’ll see what happens next month!

CONCLUSION

Despite having my very first down month ever, I”m still optimistic about the future. I took out a big chunk of debt this month, about 10%, and I plan to keep it up. When I get paid next I’m planning on putting that all towards my debt as well.

I can’t believe the year is officially 25% over! Aaaagh! It’s going so fast and I have so much to do, but I’m making progress. What about you? Let me know in the comments!

– NMI

Church

Gosh, I love a good savings rate. Market is down, savings are up and life is good.

Despite everyone getting crushed by the market, you save on.

Well done!

Shawn @ NMI

Thanks Church! I love a good savings rate too – it’s the only way I can ever hope to become FI with my average income :D.

Also, I love the feeling of security it gives me. But now that I have that out of the way, I can focus on killing this debt.

I just checked out your net worth reports and you are doing great! I can only hope to be where you are someday! Keep up the good work!