HI!

Thanks so much for stopping by the New Millennial Investor!

You can call me NMI for short, or, if you must humanize me;

then Shawn will do.

I’m a new blogger recently inspired to achieve financial independence by my early 40’s after discovering the concept during the summer of 2016.

WHO AM I?

While I don’t have any professional finance experience (e.g. I don’t have an MBA), my father did frequently embarrass me in front of family and friends by saying that I was so cheap I would squeak when I walked – and you can’t put a price on humiliation like that.

I have been a natural saver for most of my adolescent and adult life. I definitely splurged on candy like any good little kid, but after getting my first job at 18 and knowing that I was going to have to put myself through college, I carved out a saver’s sensibility.

Unfortunately, as with many things in life, school didn’t go quite as I had planned. I worked two jobs just to fund my degree, and after seven long, grueling years, I decided that the healthcare sector, at least in terms of providing patient care, just wasn’t for me.

Shit.

Equally unfortunate, I knew that my degree was not extremely useful unless I decided to pursue additional education (which I really didn’t want to do).

Fortunately, my job running a small consignment store was going well. We had just expanded, adding a second location, and I would, in the very short future, negotiate a substantial wage increase that would finally put me on par with my peers as far as earning a decent wage for my age (late twenties). I diligently saved this additional income and amassed a somewhat substantial amount of money within just a couple of years.

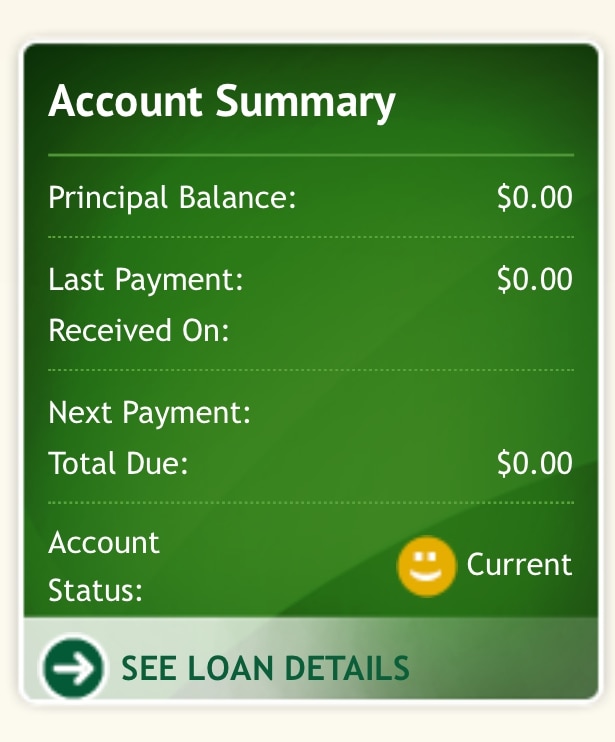

With this, I was able to pay down over $18,000.00 in student loan debt in under three years, with the last payment made on March 23rd, 2016. I felt like my hard work and diligence was finally paying off. Things were looking up.

Even with no debt, my natural instinct to save money was still there. I started to accumulate more money. But it was just sitting in my bank account, earning a tiny amount of interest. Certainly not enough to make a difference.

I started to think long and hard about my future. I knew that I wanted to be financially secure, but I didn’t know how to go about it. I knew that I had to invest if I wanted to become secure, but I had no idea where to even begin.

I didn’t make a crazy amount of money, so I couldn’t afford to lose a crazy amount of money in the stock market. I looked at investing articles online but all I ever found was “advice” that was really a scam or one big advertisement for a particular firm, trying to get you to subscribe for investing advice. I knew that I could get professional help, but I also couldn’t really afford to pay someone else to invest for me. I wanted to do it myself. I wanted something safe – something secure, that didn’t take a lot of technical knowledge or time.

Then, in the summer of 2016, I started to do research on the many different forms of investing. Somehow, somewhere, I came across an article on financial independence. Using a more passive form of investing called “index investing”, I found that not only was it possible for me to secure my financial future, but I could do it in a way that was easy, fast, and relatively without risk.

I found out that yes, even with my average income, I could save enough money for retirement – and it didn’t have to be for retirement in thirty years. I could be retired in less than fifteen, with a portfolio that would pay me to live! I was ecstatic!

All the worries I had about my future, where I was going, and what would happen to me completely melted away after discovering FI.

SO WHAT?

So you may be saying, “Why then should I read your blog? What are you doing that hasn’t already been done a MILLION times before? And by more capable people? You make me sick!”

To that I’d say, “Ow, my heart!”

HOW AM I DIFFERENT?

I’d also say that I believe I can provide a slightly different perspective on getting to financial independence early because:

1.) I’m a single man

2.) I make a less-than-average income for an adult male ($38,400.00 pre-tax)

3.) and I started investing at a later age (31)

Most of the websites I’ve read in which people reach FIRE status early are about couples striving to reach financial independence together, which is greatly helped by both incomes, or are about single people who make an above-average income (+ $60,000). Many of these people are unnaturally smart and responsible, and started investing in their early twenties (bastards!).

Unfortunately, I was not one of them. I didn’t take school seriously enough, didn’t have a plan, and, quite frankly, was too lazy to work really hard at it.

Fortunately, despite my very average circumstances, my future is looking bright!

Using the passive index investing technique, along with a little hustle and sacrifice, you’ll see that even an average income can be a tool to achieve financial independence! Here I’ll be detailing my own method and progress towards reaching FI.

MY PLAN

Check out my plan here, including my budget and my portfolio, and my net worth reports here – then follow along with me!

Because why else are we trying to reach FIRE if not for the desire to freely live our own lives, on our own terms, with the security that wealth provides?

Come and follow along with me on this journey to reaching FIRE! It won’t be quick and it won’t be easy, but it certainly beats sitting in an office for the next thirty years like this guy!

Please take a look around, and try to have a little fun! Let me know if you have any questions or comments!