With a title like ‘My Master Plan’, it’d be easy to think I’m up to something nefarious.

I promise, I am not trying to take over the world.

But I am trying to take control of mine.

Thanks to some kind, generous, and most importantly, knowledgeable people on the interwebs, I’ve been able to get some great information on personal finance.

This information has completely changed my views on investing and retiring, especially retiring early, and it’s also allowed me to formulate my own plan to reach financial independence, using JL Collins’ methods illustrated in ‘The Simple Path to Wealth’ and methods gathered from ‘Millennial Revolution’.

I never bothered to invest in the stock market until recently because I always just assumed it was difficult and risky.

While I knew that investing was key in becoming financially well-off, I didn’t know anything about it.

“I’m not willing to lose all my money for a paltry gain”, I told myself, so I just avoided investing completely.

Now that I know better, I feel like such a fool. If I had started earlier, I would be much further ahead. Unfortunately, I was pretty much clueless when it came to finance.

But I ain’t beating myself up about it (and if you’re in the same boat, neither should you) because it’s never too late to start taking an interest in bettering your financial life – and fortunately, it’s never been easier too.

MY PLAN

My plan to achieving financial independence is really simple, which is great because I can be really lazy. It’s straightforward and totally achievable, even for someone who earns an average paycheck.

Basically, by utilizing a high savings rate, contributing yearly to my investments and keeping my debt down, I’ll be able to reach financial independence within the next fifteen years!

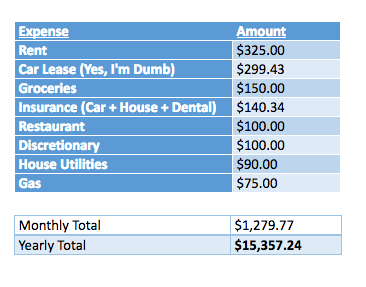

MY BUDGET

I currently spend, on average, about $15,000.00 per year. The last few years, there were months in which I was spending only $1,100.00, sometimes even less, which resulted in an overall yearly expense of about $13,000.00!

My new as of May 2017 car lease increased my yearly expenses by over $3,000.00 a year – but that’s a story for another post (that post is here).

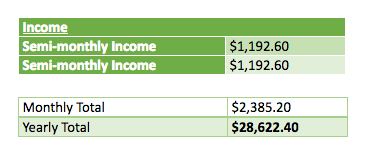

*My initial post contained a formula that included my overall income x my tax rate to equal my yearly after-tax income. I’ve since deleted that because the most accurate way of charting my income is just using my semi-monthly income x the number of times I get paid per year, like in the figure below.

This is what my monthly budget looks like:

INCOME

I get paid semi-monthly, which means I only get paid 24 times in a year, as opposed to 26 (or even 27) times for a person getting paid bi-weekly.

Wow. Looking at that after tax total makes me a little embarrassed. I should be making much more at my age. Let this be a lesson, kids; take school seriously 😀 ! Fortunately, I do have a few awesome benefits that I greatly appreciate – I don’t pay anything for health care and it’s a great plan. My job also pays for my cell phone.

Those benefits definitely save me a lot of money.

EXPENSES

I was initially determined to save about $17,000.00 per year after my recent financial epiphany (but before I got the new car).

While this is doable by cutting out my restaurant and discretionary expenses, I would be cutting out almost all of the things that make life bearable; pizza, coffee, and the occasional random splurge here and there. It would also require me to save any extra income I receive throughout the year, including my entire tax refund (which I already do).

Because I believe there’s a fine line between saving and living, I’ve decided to try to knock down my annual savings to about $15,000.00 per year.

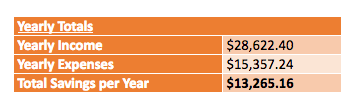

TOTALS

While this doesn’t quite put me at the $15,000.00 I was hoping I could save, this total doesn’t include other potential sources of income I may receive throughout the year, such as money for babysitting my mom’s cat, the occasional odd job or my tax refund. I generally receive a pretty sizable tax-return every year (almost an entire month’s salary) and I always save it.

With these included, not to mention the typical spending fluctuations per month, I should be able to push my savings up to $15,000.00 per year – a savings rate of 48%. Not too shabby, eh?

MY PORTFOLIO

Because I work for a small business, I unfortunately do not have access to a 401k. I do most of my investing in a taxable Vanguard brokerage account.

I’ve also split some of my money between a Traditional IRA and a Roth IRA, but I mostly contribute to a Traditional IRA now because it gives me a decent chunk of money back during tax time.

I’ve maxed out the contributions for both 2016 and 2017 (and 2018), and I expect to continue to do that every year from now on.

Since I save much more than the $5,500.00 limit (and they just increased the contribution limits in 2019) I’ll just put any additional investable income into my brokerage account.

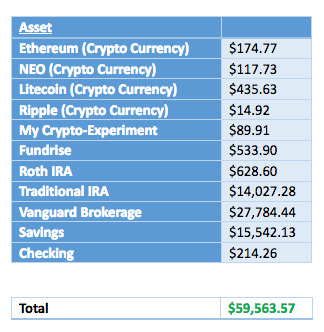

This is my current portfolio, as of March 2019:

Yes, I even have a little crypto currency! I’m hip – I’m with it! Who says that I’m lame?

MY ASSET ALLOCATION

My asset allocation is pretty simple. Right now, while I’m in the wealth building phase, I’m keeping my assets divided into 90% equities, 10% bonds. This is considered pretty aggressive, but I’m trying to build my wealth as quickly as possible.

I haven’t done the math, but my real time asset allocation could be anywhere between 80% to 90% equities, 10% bonds, and a small percentage of other investments, like crypto, Fundrise, etc.

With the inevitable economic downturn coming up, I’m trying to shift my portfolio to more cash (so I can buy when things go south) and to more conservative investments, like bonds.

I think it would be prudent for me in the next year to adjust my asset allocation to about 70% equities and 30% bonds, or even 60% equities and 40% bonds. My focus right now is paying off all of my debt, and then start to invest again, shifting my portfolio to a more conservative position.

THE NUMBERS

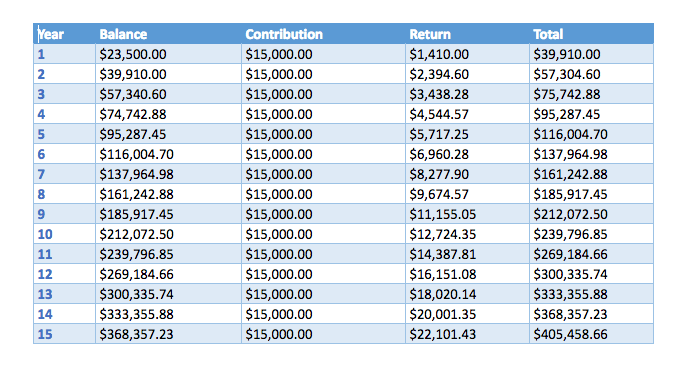

Based on my current spending, I need about $15,000.00 per year to live. Using the 25x rule, I would need $375,000.00 in order to retire early.

Based on my 48% savings rate, I can put away about $15,000.00 per year into my investments. Because I’m starting with $23,500.00 worth of invested assets, my time to FI is much shorter than if I were starting from scratch.

This is what it would look like to get there.

This is based on an average 6% return, and doesn’t include dividends, nor does it account for receiving raises or a bonus, which even I have a hard time believing won’t happen. If I were to get a second job or bump my income up in some way, I could get it done even faster!

CONCLUSION

Now, I’m sure some people will look at this and say:

“I couldn’t live on this much per year, this is so unrealistic.”

“Sure, but who wants to live in a crappy run-down duplex forever?”

“It’d not be possible to travel on that.”

For you, maybe these statements are true. Maybe you live in a HCOL area. Maybe you don’t (or can’t) live with other people, thus forcing you to pay more of your salary towards the basic necessities. Whatever the reason, this plan may not be feasible for everyone – hell, in most cases, it probably isn’t!

Not everyone shares the same path to reaching financial independence, but that’s the beauty of personal finance – it’s personal. We all don’t share the same budget, the same lifestyle or salary – but that doesn’t mean we can’t all use the same basic principles to achieve financial independence. You have the power to create your own path, just as I do mine.

What does your path to financial independence look like? What do you think of mine? Let me know in the comments!

– NMI