This post may contain affiliate links. See my disclaimer for more information.

I hate cars. So darn much.

I really cannot put into words just how much I hate them.

That’s not to say I don’t have an appreciation for the physical beauty of cars, or their practical purpose. Same for the engineering that goes behind them. I mean, who doesn’t enjoy going for a fast spin in a sweet new whip?

My problem is that I never seem to be able to make my cars last. They always crap out on me.

While I’ve only been driving for about fourteen years, I have owned five vehicles, including my most recent one, a 2001 Honda Civic. That averages out to a lifespan of 2.8 years per car. That seems pretty gosh-darn-diddly-do-darn pathetic (hey – I’m trying to keep this place PG rated, OK?).

In May of 2017, completely out of the blue, my 2001 Honda Civic died on me. I was at work and decided to go grab something for lunch, so I headed to my car. As soon as I turned the key, it started violently shaking, the engine was sputtering – I knew something was wrong.

Then it shut itself off.

Turning it on only momentarily brought it back to life.

“No!” I cried. This couldn’t be happening. I had only had it for two-and-a-half years. It had run fine just that morning. Sure, it had 190,000 miles on it and I’d had to put a decent chunk of change in it to keep it running, but I thought it had more time.

I thought we had more time!

*sobs in corner*

PAPA’S GOT A BRAND NEW BAG CAR

So, I needed a new car.

Ugh.

The entire process of obtaining a new vehicle totally stresses me out. I don’t like spending large wads of cash at once, so going shopping for a really large purchase kinda bugs me.

Fond of making it rain on them hoes, I am not.

Not to mention the entire process of buying a (new) used car is rife with pitfalls. Will I get a car that runs beautifully for two years, or is it gonna break down on the way home?

It’s never an easy process, and I was sick of getting pieces of junk that lasted no time and had to have barrels of money thrown at them to keep them running.

I decided that I was going to *gasp* get a new vehicle.

Most personal finance blogs out there will tell you this is a big no-no. In fact, even saying this will probably get me shunned and banished, doomed to an eternity in the frigid far reaches of the personal finance blogosphere.

TO LEASE OR NOT TO LEASE?

The main problem with owning or leasing a new car in this day and age is that it’s generally pretty expensive. Really expensive. The same price as my rent expensive.

The idea of having another large payment like that every month was a little stressful. Besides rent, there isn’t anything in my budget that gets anywhere near $200.00 to $300.00 a month, the typical price of a car lease. That’s a lot of money, especially for someone who’s trying to get to financial independence as soon as possible.

But part of me didn’t care – I just couldn’t take it anymore. I wanted something reliable, something that was safe, and something that was a little more modern. No matter what the payment was, I knew that I could afford it (as long as it was reasonable) as I was saving almost half of my meager income per year. Even at $300.00 a month, it’s only about 12% of my monthly take home income, which isn’t too bad.

I figured spending a little more and getting a little more was an OK trade off.

I started looking at local dealerships online. I had been pretty happy with my Honda Civic, so I decided I would look for another car from that company, though I wanted an SUV. The Civic was so small it felt like driving around in a tin can. I ended up deciding on a Honda HR-V, a compact SUV, and so far, I’ve been happy with it.

Now that I’ve been leasing a car for almost a year, with no significant problems in regard to me affording it, part of me wonders if it was the right choice.

While I like the smoothness of the ride, and the modern comforts of things like a USB player and a back-up camera, I’m not exactly loving having a car payment. And with me trying to get to financial independence as soon as possible, is it possible that this could derail it?

I figured I would do a little math* to see how I fared.

If I added up all the money I’ve spent between my used cars, including repairs, compared to what I’m spending to lease my new vehicle, what would the difference be? Would it be close? Or will buying used always win out?

Let’s get into the specifics to find out!

*I suppose you may have noticed that I didn’t do this math until after I had already leased the car. You’re probably wondering why. Well, the reason is, because I’m an idiot 😂 .

THE BREAKDOWN

MY OLD CARS

I’ve acquired quite the crappy collection of used cars over these last fourteen years.

Dodge Caravan

The first car I owned was my parent’s minivan. It was green. And embarrassing. But at that age, you gotta take what you can get. I’m pretty sure I got it for free, minus gas and some minor repairs. Because this was fourteen years ago, I don’t really remember if I had to do any major repairs, but I estimate for minor upkeep I probably spent about $1,000.00 for the few years I had it.

Ford Taurus

The next car I owned was a Ford Taurus. This car was a little nicer, and because I actually had to pay for it, it felt like more of my own car. I also had this car for a little over three years until I burned it out. Literally. I was driving from a friend’s place low on coolant and it started smoking. I paid $2,500.00 for it and probably put about $1,000.00 for upkeep.

Buick LeSabre

Then I received a car from my mom’s husband. It was his son’s. He was initially going to drive it from Michigan to California where he was moving, but then he decided against it. Good thing for him, because within thirty seconds of driving that car I didn’t think I’d be able to make it to my job across town, let alone across the entire United States. It was a piece of junk, to say the least. I paid $1,500.00 for it and put about $1,000 into it to fix the brakes, brake lines, etc. after they went out while I was driving!

I got lucky with that.

The car probably lasted for about two years, and after the second time the brakes went out, I just said, “Bye Felicia!”

Pontiac Grand Am

Then I purchased a red Pontiac Grand Am from a work friend of my dad’s. Overall, this car was in pretty good shape, and I didn’t need to put a whole lot of money into it because he was a conscientious owner. I did have to replace the brakes, a caliper and the brake lines once, but besides that, there wasn’t a whole lot of maintenance that went into it. I had this car for over three years, purchased it for $3,000.00 and probably put about $1,000.00 into it.

Honda Civic

My most recent car was a 2001 Honda Civic. I purchased it from a family friend for $2,500.00 and put about $1,500.00 for some minor repairs (I actually have the receipts! Hooray for being a responsible adult!). I had this car for about three years. This was my last car before I decided to take the plunge and lease a vehicle.

LEASING THE HR-V

The contract for my lease is pretty simple: I pay a monthly fee of $299.43 for a total of thirty-six months, with no money down. Because the dealer I went to was so generous, they paid the first month for me, leaving me the remaining thirty-five payments, for a total cost of $10,480.05.

I realize this is a lot of money. It certainly is to me.

However, there are quite a few upsides:

– It’s safer

– It’s more reliable

– I’m not responsible for repairs if something goes wrong

– Because it’s new, the chances of something going wrong are lower than if I were to buy some rando used car

– It includes new features like a rear-view camera, USB media support, etc.

– If I were to buy it, I know its exact condition because I’m its only owner

All of these things in themselves probably don’t make it worth it, but at the time, I was desperate and needed a vehicle. Unfortunately, that’s not a good enough reason to pay almost $3,500.00 a year just to drive.

Still, I will say that the piece of mind has been a much appreciated benefit. Not to mention the all-wheel drive. Super helpful in the winter. I guess it doesn’t make a difference.

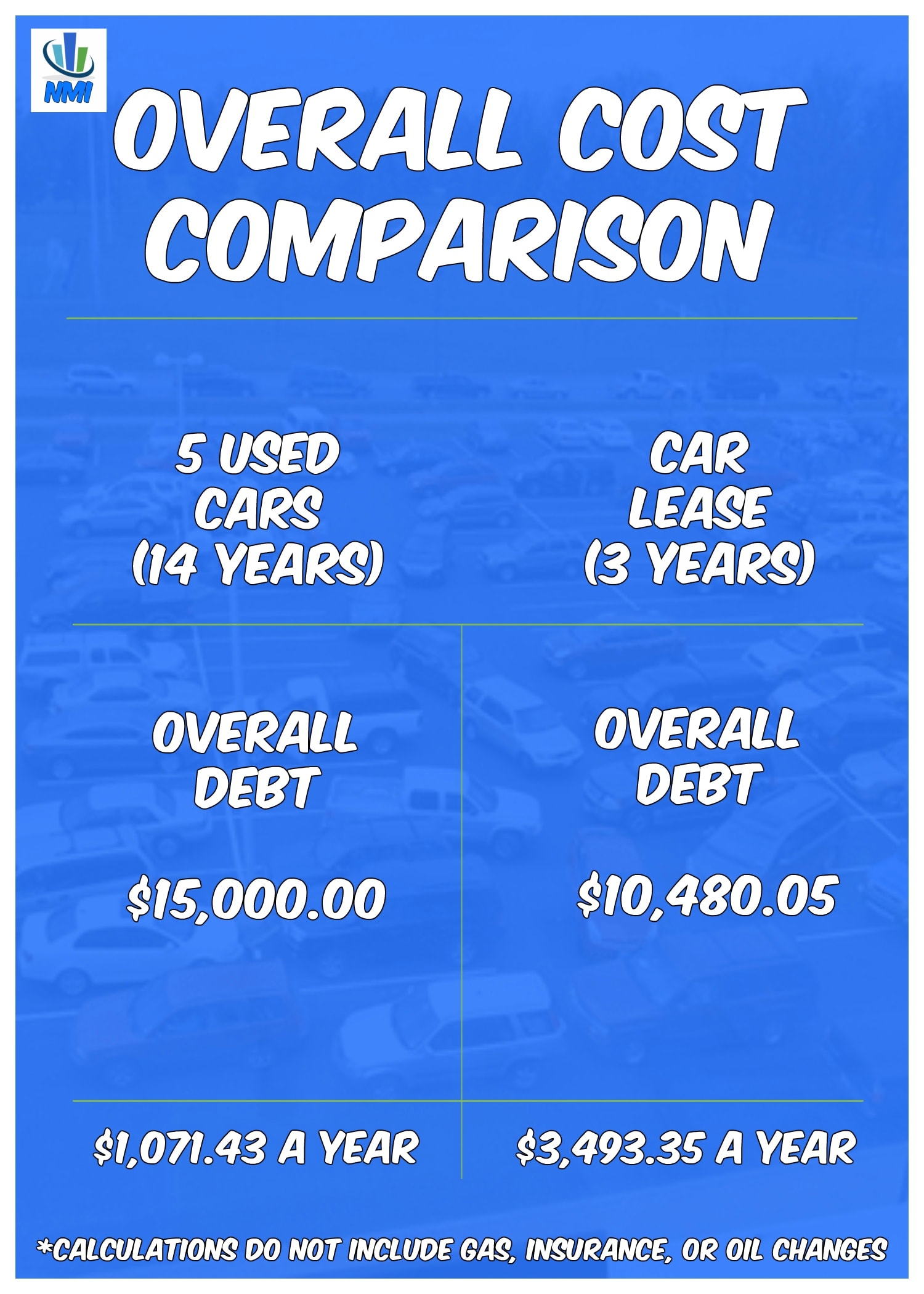

Now that I’ve calculated the overall expenses for both owning and leasing, let’s take a closer look at which one is more affordable, based on the yearly cost of each.

THE RESULTS

It’s probably not much of a surprise that purchasing used is a cheaper option than leasing a car, but I am surprised by just how much cheaper it actually is.

In my case, purchasing a used car in the $3,000 range every two to three years, even when accounting for additional repairs, is still almost 70% cheaper than leasing a brand new car.

To me, that’s eye-opening. I would never have known that if I hadn’t done the math.

But we’re not quite done with the math yet.

There is another cost here that we must take into consideration: opportunity cost.

THE TRUE COST

BUYING USED

In total, I paid about $15,000.00 to drive my used cars over a period of fourteen years, from age 18 to 31, at a cost of $1,071.43 a year. While that actually seems pretty reasonable to me, if I had somehow been able to avoid the cost of owning these vehicles and invested that money instead, over a period of fourteen years, assuming a modest 6% interest, that money would’ve amassed to a value of $23,867.13 – meaning I missed out on a gain of $8,867.13!

For example’s sake, let’s say I was still able to avoid spending any money on a car and took this $23,867.13 I had saved over 14 years and let it mature until retirement at age 65. After 34 years, this money would be worth $173,061.16!

No longer just chump change!

LEASING ONCE

In total, I am paying $10,480.05 to lease my car for three years, from age 31 to 34, at a cost of $3,493.35 a year. Not exactly reasonable compared to the used car figure. Over a period of three years, assuming 6% interest, that money would’ve amassed to $11,788.71, a gain of $1,308.36. Not as impressive as the last figure, but still.

For example’s sake, let’s say I was still able to avoid spending any money on a car and took this $11,788.71 I had saved over 3 years and let it mature until retirement at age 65. After 31 years, this money would be worth $71,770.85!

Not bad!

LEASING REPEATEDLY

This should be even more fun to calculate.

For further comparison, let’s say I enjoy leasing a new vehicle every few years, so that I’m never driving the same vehicle for more than a couple of years (also known as my boss’ life).

For simplicity sake, let’s say I paid an average of $3,493.35 every year to lease a vehicle, from ages 32 to 45, for a total cost of $48,906.90. Over a period of fourteen years, assuming 6% interest, that money would’ve grown to a value of $77,817.76, a gain of 28,910.86! If I then let that chunk mature until I was ready for retirement, 20 years later, I would be left with a staggering $249,572.09 – all without contributing any additional money!

Dang!

It’s quite easy to see how this money adds up and can have a large affect on our finances.

THE VERDICT

It’s pretty sobering to see the numbers all laid out here.

Leasing a vehicle for just three years will cost my future self almost $75,000.00!

Over a decade of used car purchases has cost my future self almost $175,000.00!

And leasing a string of new vehicles for over a decade (which I will NEVER do) would cost future lil ‘ol me an unbelievable $250,000.00!

CONCLUSION

I’ll say it. Leasing a car sucks for your wallet. Big time.

Still, I’m not entirely certain what the future holds for me and cars. Because I want to get to financial independence as soon as possible, I’ll probably pass on purchasing my leased vehicle – though I suppose that depends on what it would cost for me to purchase it. One of the biggest advantages of buying your leased vehicle is knowing its exact condition and history. I think if you’re a careful driver and haven’t gotten into any accidents, it may be worth looking into.

On the other hand, I may be able to purchase a used car from my sister. It’s only a few years old, and was a company car and she generally takes care of her cars well, so I would know it’s in good condition.

Either way, I don’t think I’ll ever lease in the future again. The verdict is in:

If you like to spend a lot of money and are looking to possibly derail your entire financial future, then leasing is for YOU!

So don’t! (But if you wanna do it one time I understand).

Do you own a car? Was it used or new? Do you lease? Or maybe none of the above?

Let me know in the comments!

My Boss Is Terrible with Money - Here Are His 3 Biggest Money Mistakes And How to Avoid Them - New Millennial Investor

[…] The BMW? Not his so all the payments return a big fat $0 (plus what you lose to opportunity cost, and yes, I understand the irony because I lease a car too). […]

9tofire

I made some gnarly mistakes like this but probably worse. My BMW 328xi lease is finally coming to an end next month but I didn’t need a new car to begin with. I made the brilliant decision to sell my 2006 Toyota Camry LE that I bought new once upon a time, which I paid off years prior, no issues whatsoever, with 80k miles. I simply got bored. I wanted bluetooth and the ability to talk on my phone through my car. What a painful lesson…But so glad I’m getting out of that and have saved up to buy a used Honda Civic. That was the very first car I got so it’s full circle for me.

Thanks for working out the opportunity cost too. What an eye opener.