It’s been two months since I started my crypto-experiment. Let’s dig in!

DETAILS

If you’d like to get all the details, including the experiment’s overall methodology, you can read my initial post here.

To summarize:

In January, I found a blog post on buyholdlong.com that detailed how purchasing $1,000.00 worth of the top 10, 25, 50, 75 or 100 currencies and holding onto them for one full year could lead to unbelievable gains – gains as high as 10,000%! You can find that post here.

In January of 2018 I purchased forty-three different currencies out of the top hundred on coinmarketcap.com, ranging from mere pennies per token to multiple dollars, with each currency holding an overall value of about $20.00. I intend to hold onto these for one full year.

As much as I love money and saving, I felt like this opportunity was just too good to be true. If I could turn $1,000.00 into even just $5,000.00, that would cut my time down for retirement by six months! If I could turn that $1,000.00 into $50,000.00, it would cut down my time to retire by a more than three years! What’s losing $1,000.00 compared to missing out on a gain to $10,000.00? Or more? For potential like that, a thousand bucks is nothing.

I figured I had to try it out for myself.

Note: I’ll be starting every month’s report on the 18th as that was the first day of the experiment, and I’d like to keep these reports consistent.

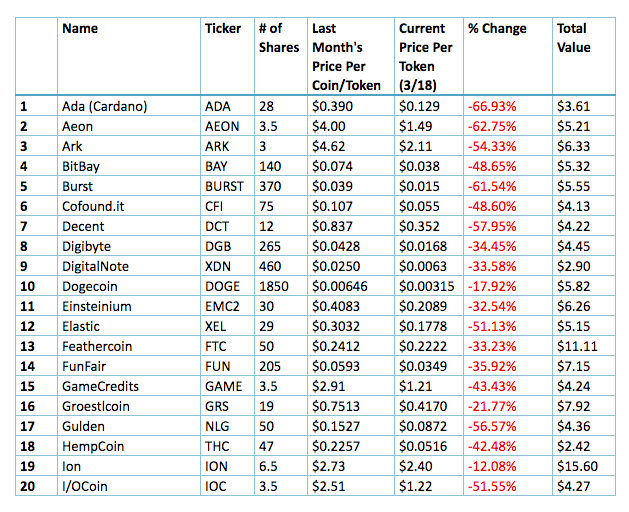

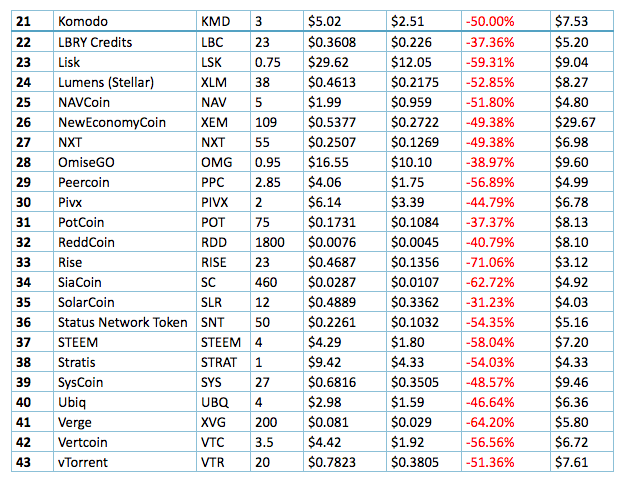

MY PICKS & RESULTS

This is the list of all the currencies I purchased for my experiment, including the name, ticker, number of shares, the initial price per token, the current price per token, the change from last month represented as a percent, and their current overall value. These values were taken on Sunday, March 18th.

WEEK TO WEEK ANALYSIS

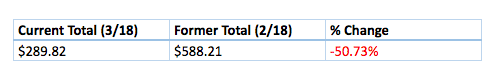

This was another rough month, which stinks, cause it’s only the second one! It was pretty much a straight shot down the tubes this month. Let’s take a closer look.

Note: Because February is a shorter month, it affected the schedule, with some weeks being shorter and others longer so that the last day would end on the 17th.

Week #1 – 2/18 to 2/25

Here’s the start of week one. Starting off at about $90.00 down compared to last month’s final week, which was $681.15.

And ending the week an additional $115.00 down. Sweet.

Week #1 Low – February 25th – $476.41

Week #1 High – February 19th – $603.76

Week #2 – 2/26 to 3/5

Here’s the start of week two. Up a little bit from last week’s end.

Overall, not a terrible week. Provided this downward trend doesn’t continue (which you can see it does).

Week #2 Low – February 28th – $476.45

Week #2 High – March 2nd – $533.35

Week #3 – 3/6 to 3/13

Here’s the start of week three.

And the end. Down almost $75.00 from the start of the week.

Week #3 Low – March 10th – $379.34

Week #3 High – February 4th – $475.07

Week #4 – 3/14 to 3/17

Here’s the start of week four.

And the end.

Week #4 Low – March 17th – $294.94

Week #4 High – March 14th – $382.65

This month’s variations between highs and lows was quite large. The highest high was $603.76, and the lowest low was $294.94, a difference of $308.82. That’s a loss of almost 51%, which was even worse than last month!

CONCLUSION

This month wasn’t a great one, but I’m not really concerned.

I wish things were progressing forward more steadily, but I am undeterred! I have no plans to sell any of these tokens, no matter how far they drop!

I’m holding out for the long term – and in that way, I firmly believe that this experiment will be a success.

Remember, when it comes to crypto, never bet more than you’re willing to lose!

Are you investing in any cryptos? How’s your portfolio doing? Please let me know in the comments!

Leave a Reply