This post may contain affiliate links. See my disclaimer for more information.

Welcome to the seventh net worth report here at NMI!

It’s hard to believe another month has come and gone.

And it was a pretty rocky one.

On most fronts, this month was pretty rough on my finances.

But I’m in this for the long haul, so I ain’t worried about it. Plus, with a few extra sources of income this month, overall, it’s gotten me closer to my goal of financial independence.

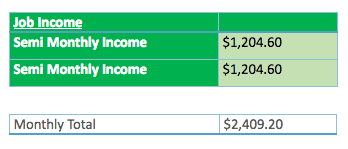

For those new to my net worth reports, I’d like to give you a few minor details. I get paid semi-monthly, which means I get paid on the 15th and the last day of the month.

Sometimes my money isn’t made available to me until two or three days after the month has already changed, so in order to ensure the most accurate net worth reports, I will always include both incomes. As such, my reports will be made available on the third or fourth day of the following month, possibly a few days after.

In rare circumstances in which I fail to get paid on time, I will either wait until that money is made available to report or I will include it in the following month’s net worth report.

You can find the latest and/or past reports here.

These figures are accurate as of the end of the day, March 4th.

MY INCOME

JOB INCOME

Good God, February was slow at work. So slow, that I actually didn’t get paid at all throughout the month of February – until the last day. Then I received both paychecks. Thank goodness.

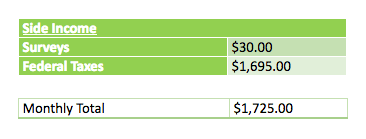

SIDE INCOME

For the first time since I’ve been doing these reports, I actually have some additional side income to report.

The biggest addition to my income, which was really needed since I hadn’t gotten paid all month, was receiving my federal income taxes back. I filed super early and got them back within ten days. That was awesome. I should be getting my state taxes back shortly too, which will be included in next month’s report.

I also took a survey that was mailed to me quite some time ago. I was paid thirty dollars cash for completing it, and it took maybe an hour. I’d love it if it could be an ongoing thing, but I don’t think that’s going to happen. Still, a nice little bonus this month.

TOTAL INCOME

![]()

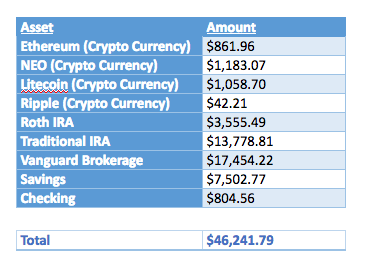

MY ASSETS

SAVINGS

With the receiving of my federal taxes, I was able to save quite a bit this month. I put the entire chunk of federal taxes into my savings, automatically. I also saved most of my paychecks since I didn’t get paid until the end of the month, and my savings has been quite low since last month, when I took out $7,500.00 and put it into my traditional IRA and my brokerage account.

INVESTMENTS

February was another volatile month for cryptos, but I still ended up doing quite a bit better than last month. Unfortunately, most of my stock investments are down. Both my Roth IRA and my Traditional IRA’s values are down from last month, but my VTSAX fund with Vanguard is doing better.

My most immediate goal is to have $10,000.00 in savings. Ever since I took that $7,500.00 chunk out in January to buy some more investments during the dip, my savings has been quite low. Uncomfortably so. Having just a few thousand in cash makes me feel vulnerable. I think $10,000.00 is a good figure to shoot for. Then I’m going to focus fully on my debt.

Remember, when it comes to cryptos, never part with more money than you’re willing to lose! I’ve learned that the hard way!

Here’s a link to my article on cryptocurrency that every beginner should check out before jumping in.

*I decided to try an experiment in which I purchased 43 different cryptocurrencies (worth about $900.00 total) in the beginning of 2018 with the intent of holding onto them for one full year. You can check out the initial post here. I will be posting updates to that portfolio around the 15th of each month. I’ve decided to separate that portfolio from my net worth portfolio as it’s an experiment, so you won’t see the balance of that in these monthly reports.

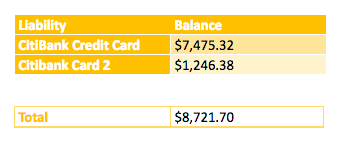

MY LIABILITIES

I know, I know, it keeps going up. Ugh.

While debt has always been a concern of mine, I’m trying to get to $10,000.00 in savings for when there’s another crash, as soon as I can – so my debt is going to have to wait another couple weeks. Once I get to that, that will be my focus. I was doing well last month, but with me not getting paid until the very end of the month, I paid for my rent with *GASP* a credit card – so that added a huge chunk to my credit card balance. My second card still has “no interest” until later this year, so I don’t feel bad carrying a balance on that. But I am trying to get them down – I promise!

I really recommend automating all of your bills, especially if they allow you to pay with a credit card. You set it up once and you don’t have to worry again. The only ones I don’t automate are accounts that need a checking account – you want to be sure the money is in there before it gets debited.

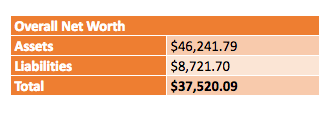

MY NET WORTH

An increase of + $1,048.94!

I’m getting closer and closer to another milestone! It’s a slow road but I am making progress, and if I say so myself, I think good progress. I was pretty convinced this was going to be the first down month since reporting these, but my tax return made up for it!

I’m still trying to find ways to increase my income this year, but they just haven’t panned out yet. I’m going to keep trying though! I want a life of financial independence so badly!

I want my life to be like this later, when I have kids:

How’s your 2018 going? Achieved any goals yet? I’d love to know!

Jim@MyCareerReboot.com

Hey Shawn, I like the simplicity of your site and the straightforward data. I’m going to check out your info on crypto as I haven’t dabbled in that as of yet, but am curious about the long term potential. Also, thanks for following me on Twitter. I look forward to following your story.

Shawn @ NMI

Thanks for the compliments, Jim!

I think now would be a great time to get into crypto as the prices recently plummeted to the lowest they’ve been in quite some time. I think the major currencies like Ether, Bitcoin and Neo will rebound and are still solid investments, even if you’re investing with just a couple hundred bucks.

Thanks for the like and follow on Twitter. I’ll have to check your site out as well.

Thanks for reading and commenting!