This post may contain affiliate links. See my disclaimer for more information.

Most people, whether they’re heavily involved in the personal finance community or not, are familiar with the term, “net worth” – the amount of your assets minus your outstanding liabilities. If you’re inching towards financial independence like me, it’s likely you already track this.

Most people striving for early retirement are analytical people, so they likely know their financial independence number (current expenses x 25) and their target retirement date too.

On the path to FIRE, these are all necessary things to know. I know mine.

But one stat that I don’t think gets enough attention is exactly how much of our own money we need to save to get to FI.

Take my life, for example.

According to “My Master Plan to FIRE“, I can live on $15,000.00 a year, which means I need $375,000.00 in total to retire.

While, to me, this is a tremendous amount of money to be saved, with time and interest, I know it can be done.

But how long will it take? And, more importantly to me, exactly how much will I have to contribute myself?

While a large chunk of that eventual $375,000.00 will be pure interest, a (very likely much) larger chunk will have to come from me directly.

But just how much, exactly? $100,000.00? $200,000.00? More?

I wanted to find out.

Because this figure is the amount we directly need to contribute to our retirement account in order to reach financial independence, I call this figure our “get worth”.

Unfortunately for me, this concept has already been claimed and named by someone much smarter than myself.

The concept is called present value.

WHAT IS PRESENT VALUE?

According to the dictionary, present value is defined as “the value of a sum of money in the present, in contrast to some future value it will have when it has been invested at compound interest”.

For example, the present value of $10,000.00 today is $10,000.00, but in ten years at 6% interest, it will be worth $17,908.48.

While this kinda explains the figure we’re after, a better definition of present value is stated as “how much you would need to deposit or invest today in order for the investment to grow to a desired future amount within your desired time frame”.

In other words, we would need to invest $10,000.00 today in order for it to grow to $17,908.48 in ten years based on 6% interest.

Present value is the amount you must contribute to your portfolio, right now, that will eventually grow into the amount needed for financial independence without any further input from you.

The only further ingredients necessary are time and interest.

We can use this concept to figure out the amount we need to contribute directly to our own retirement accounts in the pursuit of financial independence.

But first, there are two critical pieces of information we must know: our target retirement date and our FI number.

WHAT YOU NEED TO KNOW

Our get worth is based on our target retirement date and our FI number.

You may know these. If not, they’re easy enough to calculate.

Your financial independence number is simply the result of the multiplication of your current annual expenses by twenty-five. This is the amount of money you need in total for your investments to generate passive income that can support you. In other words, this is the amount you need saved before you can retire.

The amount of time we have until we want to take early retirement is personal, but will probably be based on a few things: your current net worth, your FI number, your salary, your expenses, and your savings rate. However, for this calculation, it can be however many (or few) years as you want it to be.

Once we have these figures, we can calculate our get worth.

HOW TO CALCULATE IT

There are three different ways to calculate the present value: an instant calculator, simple math with a calculator or an old-fashioned equation. I was going to list all three ways, but the calculator is so easy to use and is easily configurable, it makes no sense to do it by hand. As they say, “time is money!”.

INSTANT CALCULATOR

After searching for hours, I found a present value calculator on a great site called “Free Online Calculator Use.com“. Click the link to go right to the calculator!

This is definitely the easiest way to calculate present value.

Scroll down until you see an unassuming table that looks like this:

This is our calculator. Put your FI number in the “future lump sum” row, the number of years in which you want to retire in the next row, set the “present value discount rate” to 6% in the third row, and leave “frequency of discounting” set at “annually”.

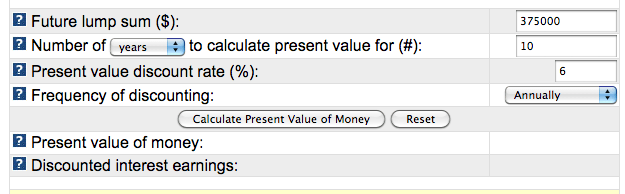

Discount rate is basically reverse interest. Because I like to be somewhat conservative with my estimations, I use 6%, but feel free to use whatever interest rate you like. (I’ve since played around with the calculator with various numbers).

These are my numbers based on my plan:

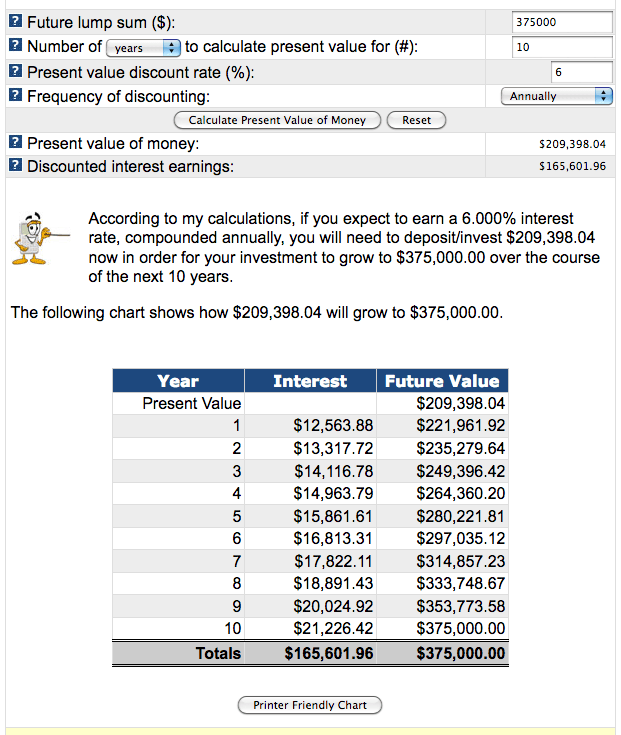

And the results:

Our results come out to $209,398.04.

If that isn’t fun enough for you, you can always get your number by doing some simple math.

MATH WITH CALCULATOR

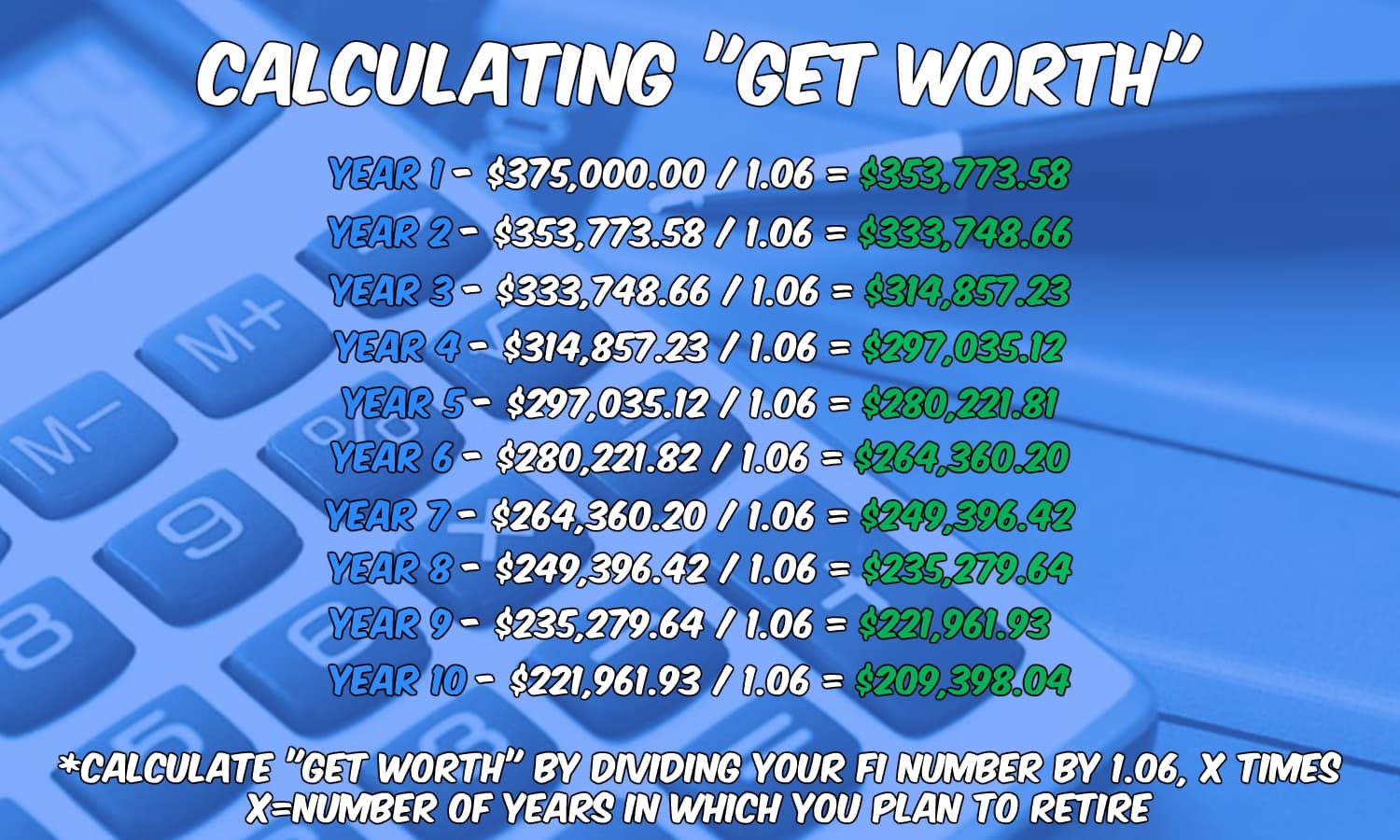

Grab your calculator and input your FI number, then divide it by 1.06. Continue to divide the results by 1.06, one at a time, for each of the years in which you want to retire early.

Generally, we assume a 6% interest rate when we calculate future investments as it’s pretty conservative, so we’ll use the same rate in this calculation to account for interest earned. Here’s what it should look like:

Dividing $375,000.00 by 1.06, ten times in a row, equals $209,398.04.

WHAT THIS MEANS

If I want to retire in ten years, this is the amount I need saved right now in order to reach $375,000.00 in an investment account in about ten years at 6% interest.

But, let’s say that I have $50,000.00 in assets right this moment – subtract that from the amount needed, and that means I’m a little less than 1/4th towards the way to reaching the principal amount necessary to get me to FI.

But let’s say I then decide to go on a frugal kick (that should totally be a blog name) and get rid of my car, stop eating out, etc., and can live on $12,000.00 a year. Suddenly I only need $300,000.00 in total assets to retire and just $167,518.43 contributed.

Now, with over forty-grand in saved assets, I’m already almost one-quarter of the way reaching the principal balance needed to be FI within ten years! That’s not bad at all!

BENEFITS

The beauty of the “get worth” idea is that once you reach this principal amount, you’re free to do with your other money as you wish, as you’ve already set your future self up for success.

For me, if I were to have my $210,000.00 saved, then the only thing keeping me from financial independence is time. You can just sit back and watch your money grow until it reaches the amount needed to retire.

If you want to keep working and add to it, watching it get bigger, you can! If you want to go part time, or maybe take some time off to find yourself, you may! With your “get worth” money fully in place, you only need enough income to cover your basic living expenses. You don’t have to save anymore (not really)!

As long as you can cover your basic necessities, your only worry is watching your portfolio get bigger and bigger every year (but no one really worries about that).

AND IF YOU’RE NOT IN A RUSH

The greatest thing about becoming financially independent is that we have control over getting there.

And while there are always things that we’ll need in life, like food to eat, a house to live in and a way to get around, it’s generally possible for us to cut back on these things when necessary.

But even better, let’s say you’re happy where you are right now and aren’t racing to get to financial independence – well lucky for you, cause this means you’ll need less overall to get there.

The longer we can wait to retire, the less we need to save.

Consider our example above.

In order to retire in ten years with $375,000.00, we needed to contribute $209,398.04.

However, if we were able to wait a few years longer, say, fifteen years, then we would only need to save $156,474.40, a difference of $52,923.64! And we’ll still get to retire with $375,000.00!

That is a huge difference.

CONCLUSION

While I don’t think calculating your “get worth” is a necessity, I do think it’s helpful to know.

It’s nice to know the amount needed to contribute myself to get to FI.

It gives us a clearer picture and gives us something to reach for.

Have you calculated your get worth? What’s yours? I’d love to know!

xrayvsn

I definitely like the term “get worth” over present value.

My big issue is these numbers always make you assume a certain rate of return (is 6% to much, too low, etc). And of course the sequence of returns for these rates is huge as well that could impact your financial path one way or the other. But as a starting point it does give you a number to shoot for to try for the present.

Shawn @ NMI

Hey Xrayvsn!

I kinda wrote the article more for fun, and to give people (and myself) an idea of principal amount saved to shoot for. I agree that I wouldn’t use the figure for anything more than a rough estimate, just because of variables, but it’s kinda fun to mess with the calculator and see the different numbers that come up. I used 6% as I feel that that’s very conservative, while still totally feasible. You’re right though, the sequence of returns for the next few years is bound to be interesting, affecting this figure – good thing I’m not retiring right now!

Thanks for reading and commenting!