The idea of purchasing real estate kinda scares me:

Whether that’s the purchase of an investment property or a home for myself, the idea of owning a piece of property, including all the things that could go wrong with it, gives me serious pause.

I know for many people investing in real estate can be a great thing. Lots of people build their wealth exclusively through real estate. If you know what you’re doing, it’s absolutely possible to make a ton of money doing it.

Unfortunately, I don’t think I really have the stomach for it.

I’m not much for risks. Nor am I a great lover of the unknown. And buying a house is fraught with “the unknown” and “the unexpected”.

Broken water heaters. A sunken floor. Mold.

There are a million things that could go wrong, and when you’re the owner, you’re on the hook.

Still, I’ve always been curious about investing in real estate. In fact, I’d be eager to invest in real estate if there wasn’t such a high barrier of entry.

If you could do it without having to shell out a bunch of money, if you didn’t have to manage properties or meet with the bank or agents, and if you could invest with small amounts, over time – then I would think about doing it.

Fortunately, there’s a new service called Fundrise that can help with that.

WHAT IS FUNDRISE?

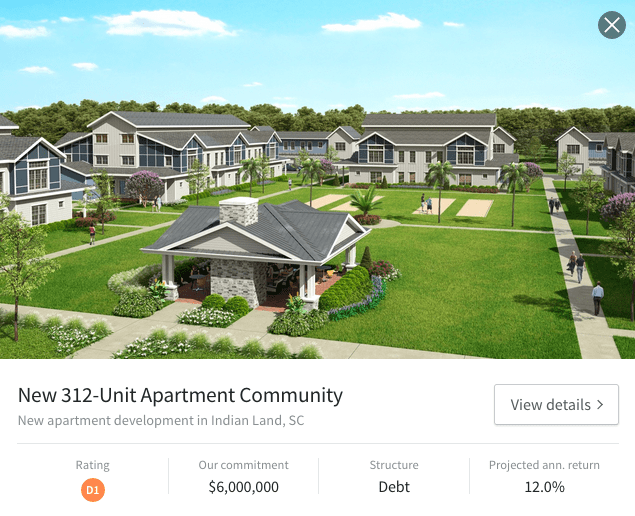

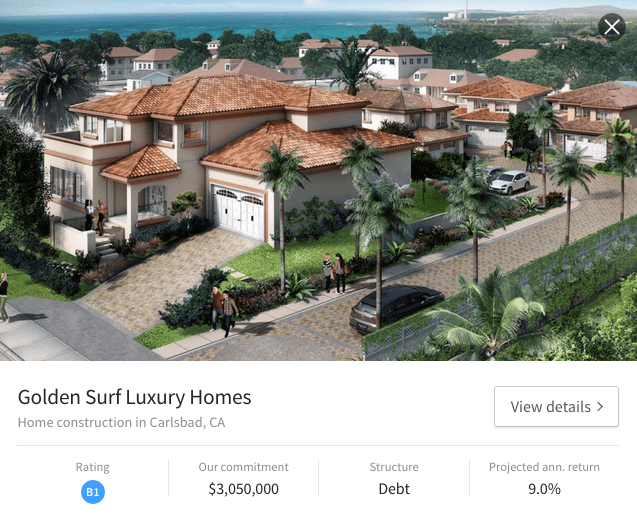

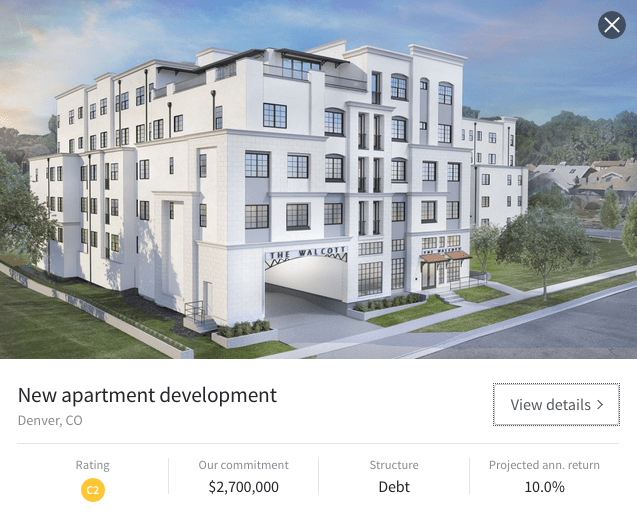

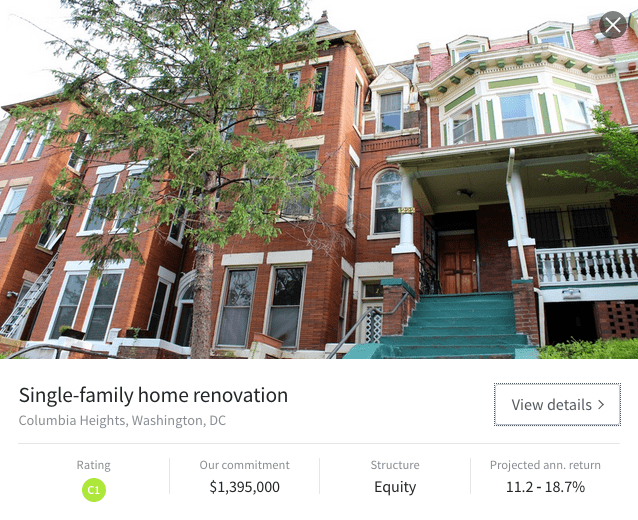

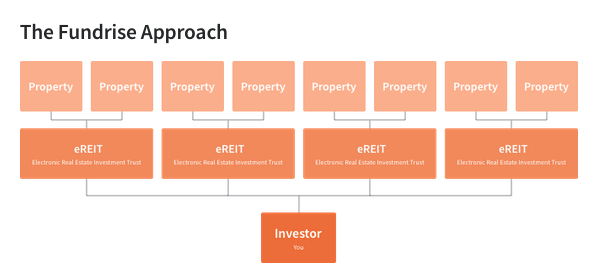

Fundrise is a new service that allows us to invest directly in privately owned real estate through a proprietary technology called an eREIT.

Each eREIT is a portfolio of private real estate assets located throughout the United States that Fundrise identifies, acquires, and manages on our behalf.

Assets range from apartments and hotels to office buildings and shopping centers.

Some are built from scratch, while others are purchased and renovated by Fundrise.

Further, from Fundrise directly, “An eREIT allows an investor to diversify across many properties at a relatively low cost and with minimal effort. Fundrise eREITs are offered directly to investors via the Fundrise website, without any brokers or selling commissions.

Unlike other REITs, our eREITs offer more transparency and roughly 90% lower fees. As they are non-traded, they generally have less liquidity than REITs that are publicly traded. They also have a lower correlation to the broader market, and may, therefore, offer greater protection from market volatility.”

WHAT’S AN eREIT/eFUND?

Investments on Fundrise are allocated across a diversified mix of what they call “eDirect offerings”. These are eREITs and eFunds, which are portfolios of private real estate assets located throughout the United States.

Portfolios generally consist of investment properties, development projects, and other asset classes, including real-estate related debt securities.

There are seven different eREITs and three different eFunds through which we can invest.

Each fund has different investing goals, is based in a unique location, has its own risks, is subject to its own timeline, and has its own projections.

eREITs

Income eREIT I & II– These eREITs specialize in a diversified portfolio of commercial real estate investments through the acquisition of commercial real estate loans.

The Growth eREIT I & II – These eREITs specialize in the acquisition of commercial real estate properties.

The East Coast eREIT – This eREIT’s portfolio mainly consists of multifamily units, development projects, and other real estate asset classes located on the east coast. Units are located in Massachusetts, New York, New Jersey, North Carolina, South Carolina, Georgia and Florida, as well as the metropolitan statistical areas of Washington, DC and Philadelphia.

The West Coast eREIT – This eREIT’s portfolio mainly consists of multifamily units, development projects, and other real estate asset classes located on the west coast. Units are located primarily in California (the Los Angeles, San Francisco, and San Diego areas), Washington and Oregon.

The Heartland eREIT – This eREIT’s portfolio mainly consists of multifamily unit, development projects, and other real estate asset classes based in the middle of the United States. Units are located principally in Texas, with a few properties in Illinois and Colorado.

eFUNDS

The LA Homes eFund – This eFund’s portfolio exists to acquire property for the development of for-sale housing in the Los Angeles metropolitan statistical area.

The DC Homes eFund – This eFund’s portfolio exists to acquire property for the development of for-sale housing in the Washington metropolitan statistical area.

The National eFund – This eFund’s portfolio exists to acquire property for the development of for-sale housing in the metropolitan statistical areas in which Fundrise’s sponsor is not currently sponsoring.

Unfortunately (or fortunately, if you’re a noob real estate investor like me), we can’t choose our eREITs directly.

Rather, the plan we choose decides our assets and their allocation itself.

CHOOSING AN INVESTMENT PLAN

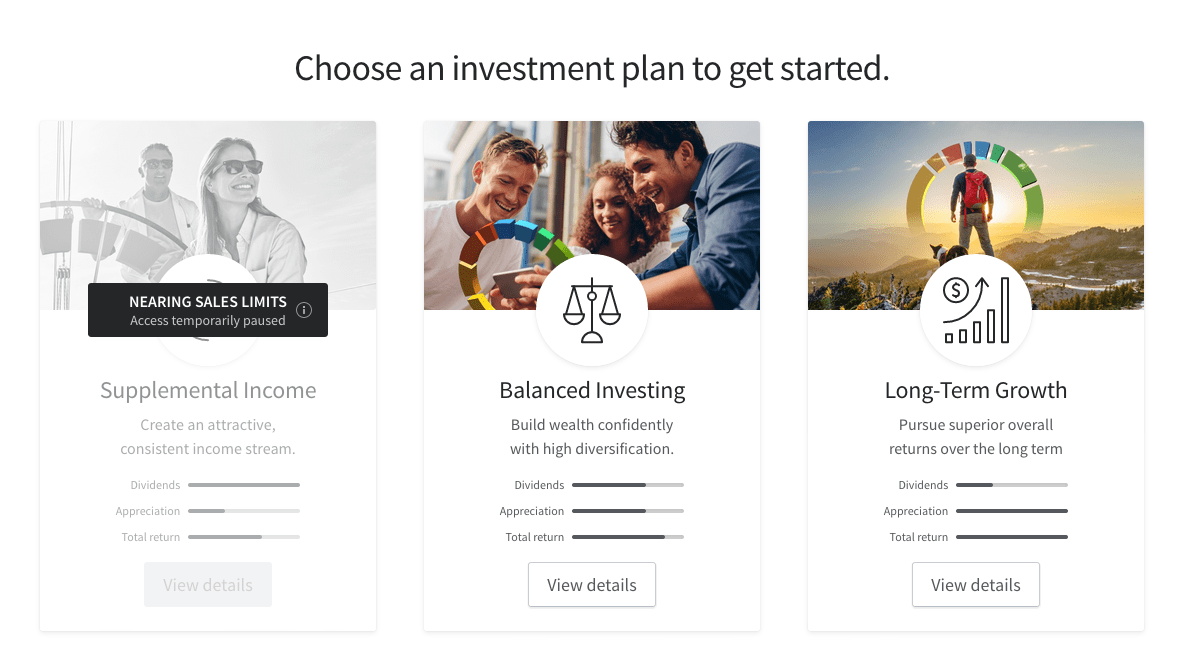

Fundrise has a few different plans that they offer based on your risk tolerance and growth goals.

Here’s an infographic giving a brief overview of each category:

Unfortunately, at the time of my sign up, the supplemental income category was put on hold for new investors.

Here’s some additional information on each plan.

SUPPLEMENTAL INCOME

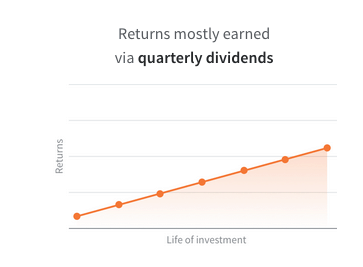

The goal of the supplemental income category is to provide the investor with steady income every month through dividends. The goal is to increase income through dividends, not appreciation. Though some appreciation will naturally occur, it is not the focus.

BALANCED INVESTING

The goal of the balanced investing category is to provide the investor with a greater total return due to both dividends and appreciation.

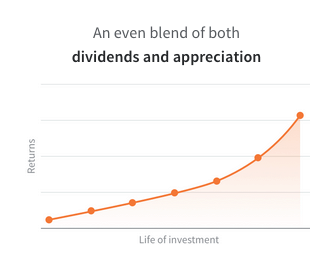

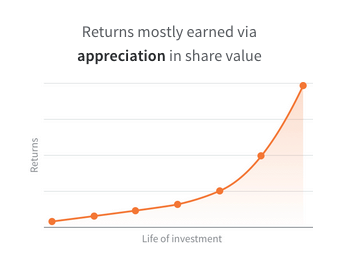

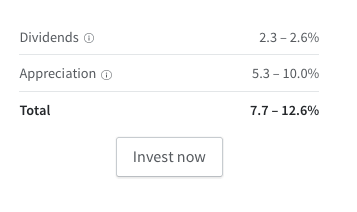

LONG-TERM GROWTH

The goal of the long-term growth category is to provide the investor with the maximum amount of total return over the long term, with a much greater emphasis on appreciation than dividends.

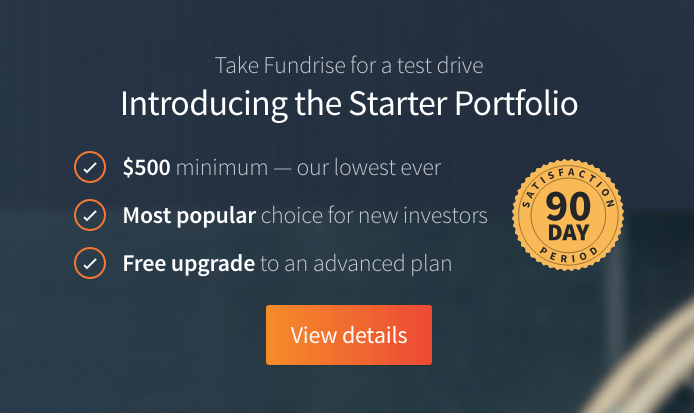

STARTER PLAN

The goal of the starter plan is to provide the investor with the easiest way to invest in Fundrise.

This plan is pretty basic. It invests in four different funds, none of which we have control over.

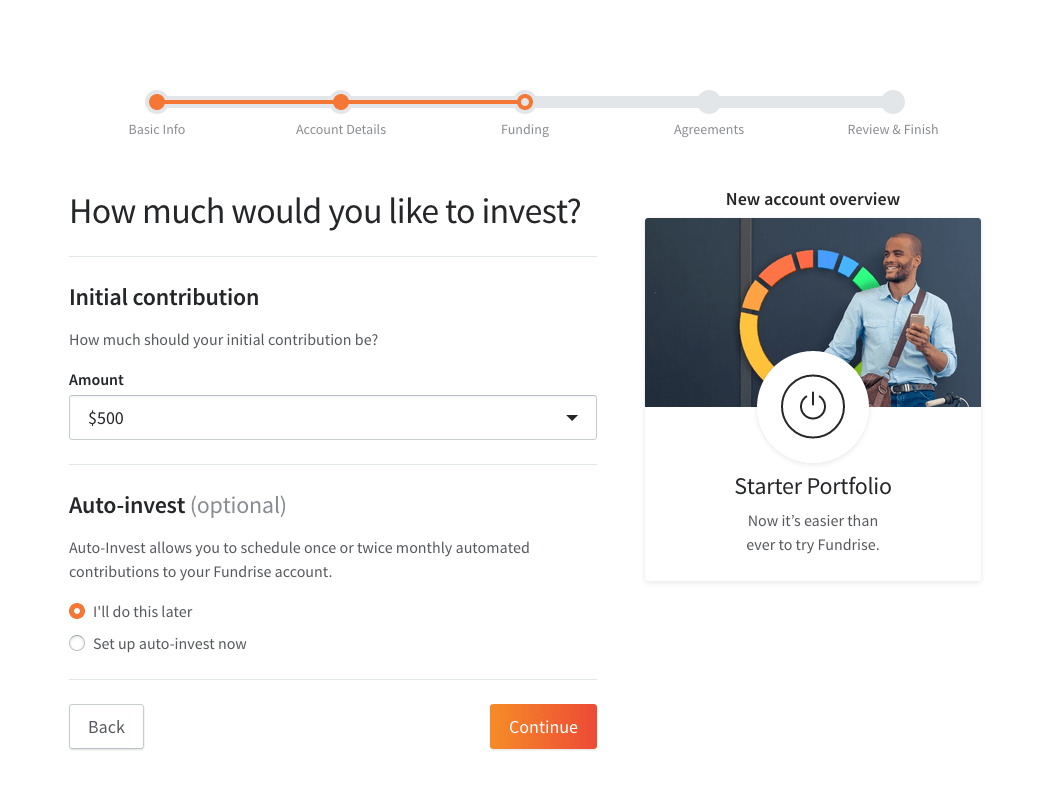

This is the one I’m going to use. It only requires a $500.00 initial investment, which you can upgrade once you reach $1000 in investments.

Fortunately for us, there’s a new option that will allow us to invest with just $500.00. You can find it near the bottom of the page on Fundrise’s the home page (www.fundrise.com).

Each of these three categories has their own strength and weaknesses.

They also require an investment cost of at least $1,000.00.

Because I’m only trying this out, and wanted to put a small sum forward, I decided to try out their starter plan.

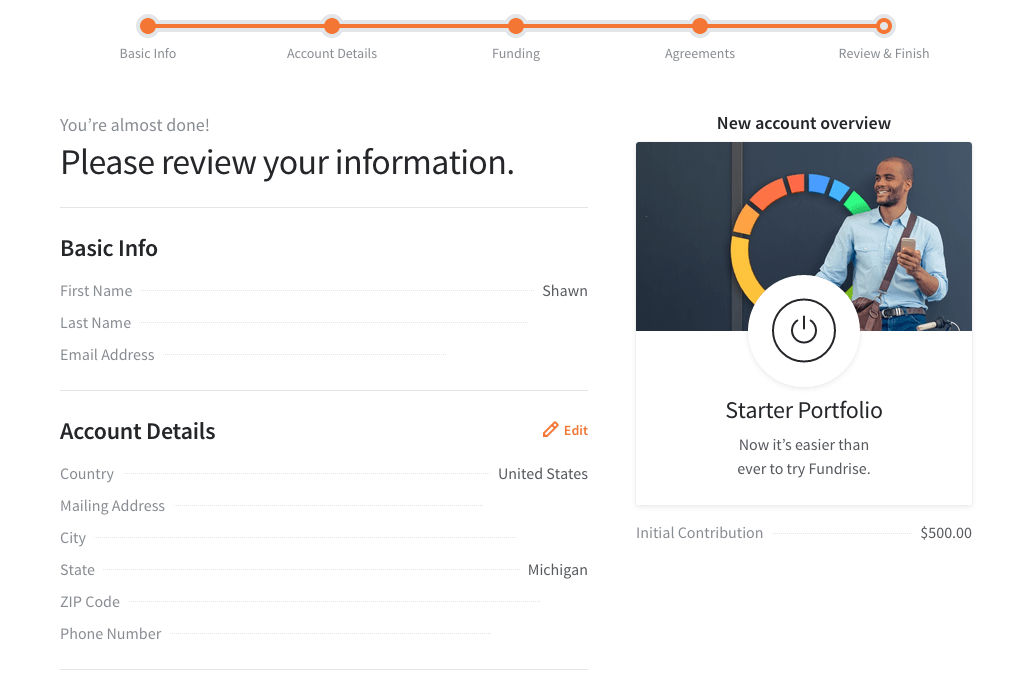

WALKTHROUGH FOR ACCOUNT SET UP

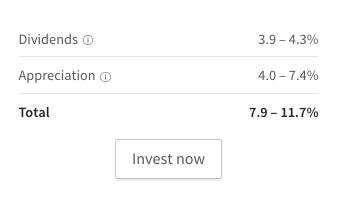

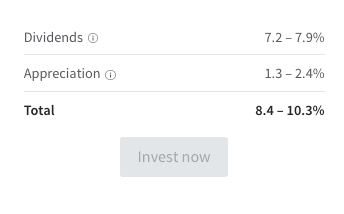

Click “view details” and it will take us to another screen with an “invest now” option. It looks like this:

You can click “invest now” to get started right away but it may be worth taking a look around the site, or some additional documents, like the circulars associated with each eREIT, the frequently asked questions section, or take a gander at the investing glossary, etc.

If you’d rather go right into creating an account, skip ahead to the walkthrough section.

CREATE AN ACCOUNT

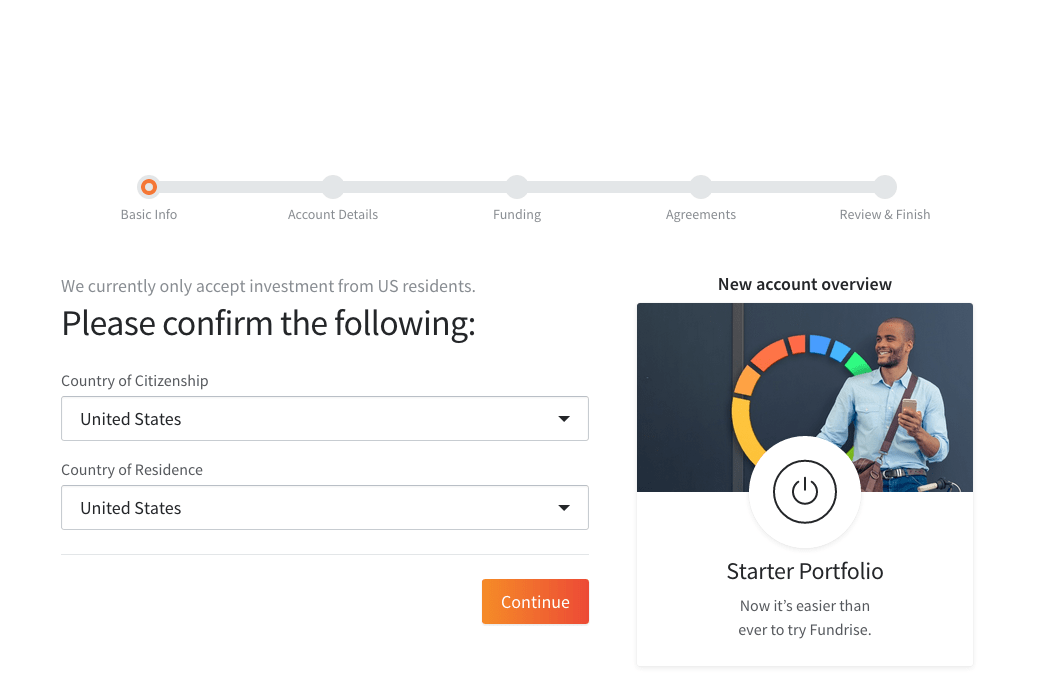

We must first confirm we are a United States citizen. Fundrise can only be accessed by US citizens.

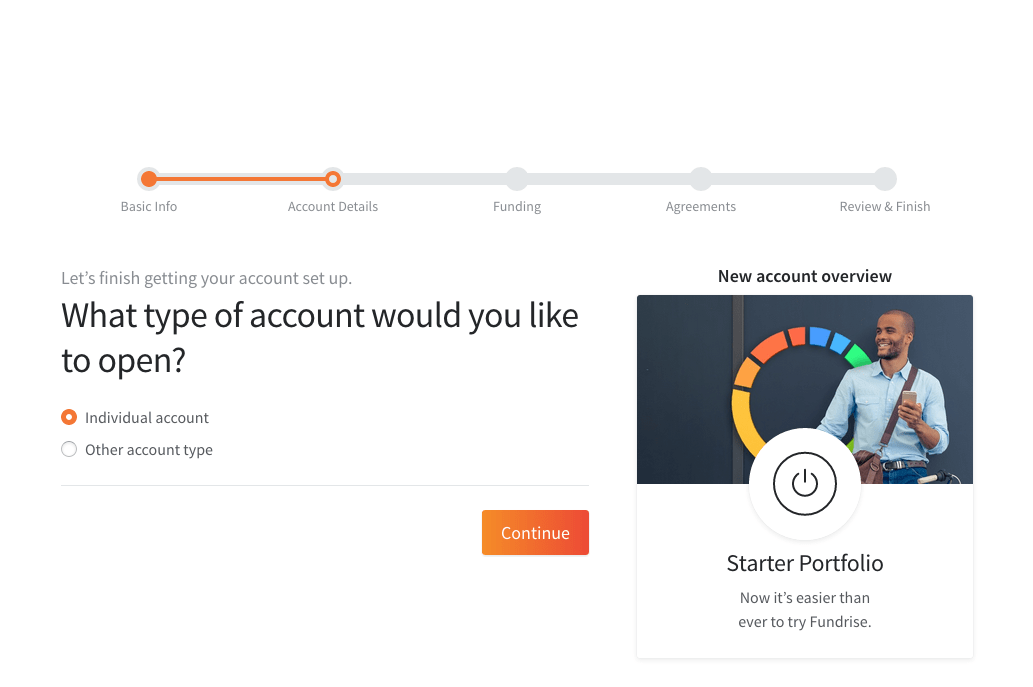

Next, we’ll choose our account type.

We can choose between an individual account or other account type.

Most people will choose individual. If you’re a regular investor, like me, choose that one.

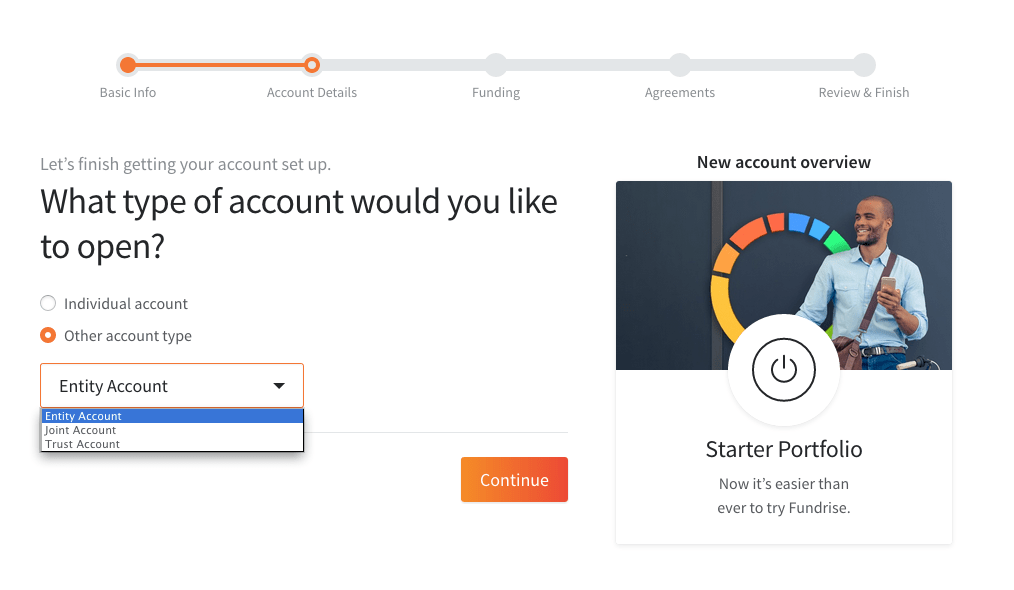

We also have the option of choosing between three other accounts:

The other account options are entity, joint or trust.

Entity: Commonly used by limited liability companies, limited partnerships, C corporations, and S corporations.

Joint: Used for people who want to open an account together, like with/for a spouse.

Trust: An account in which a third party controls funds for the benefit of another party.

Pick the account most relevant to your situation and goals.

For the purpose of this walkthrough, I’ll be using an individual account.

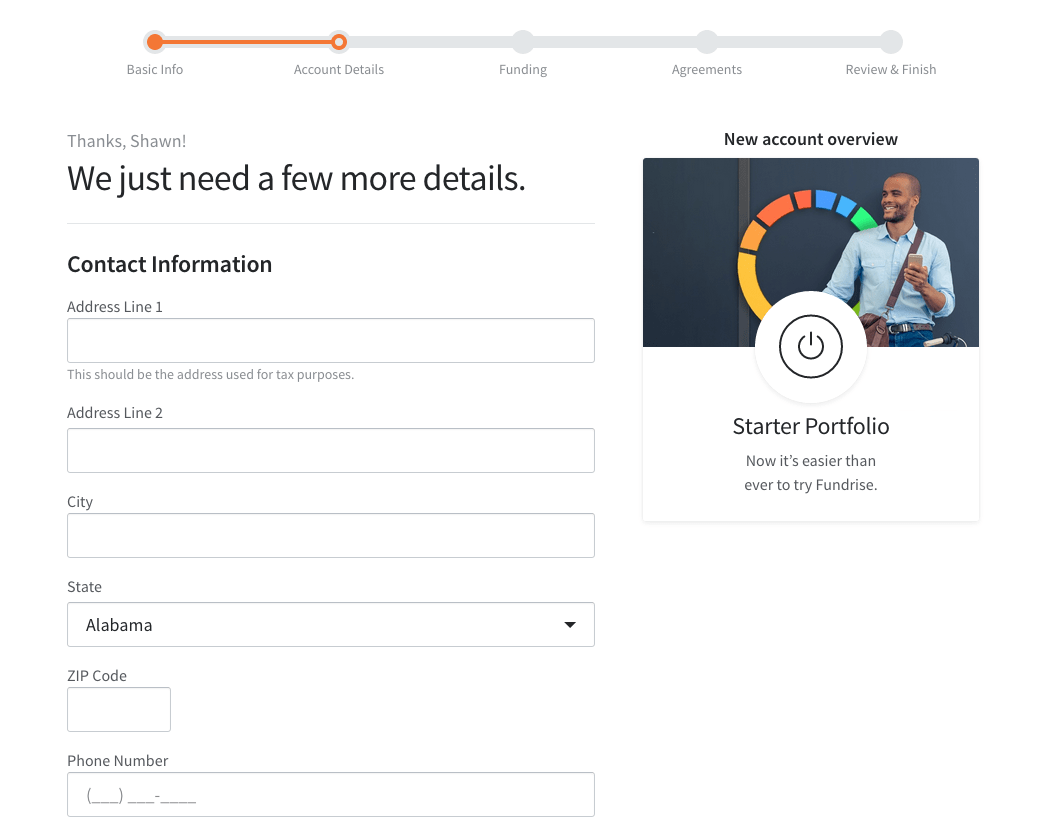

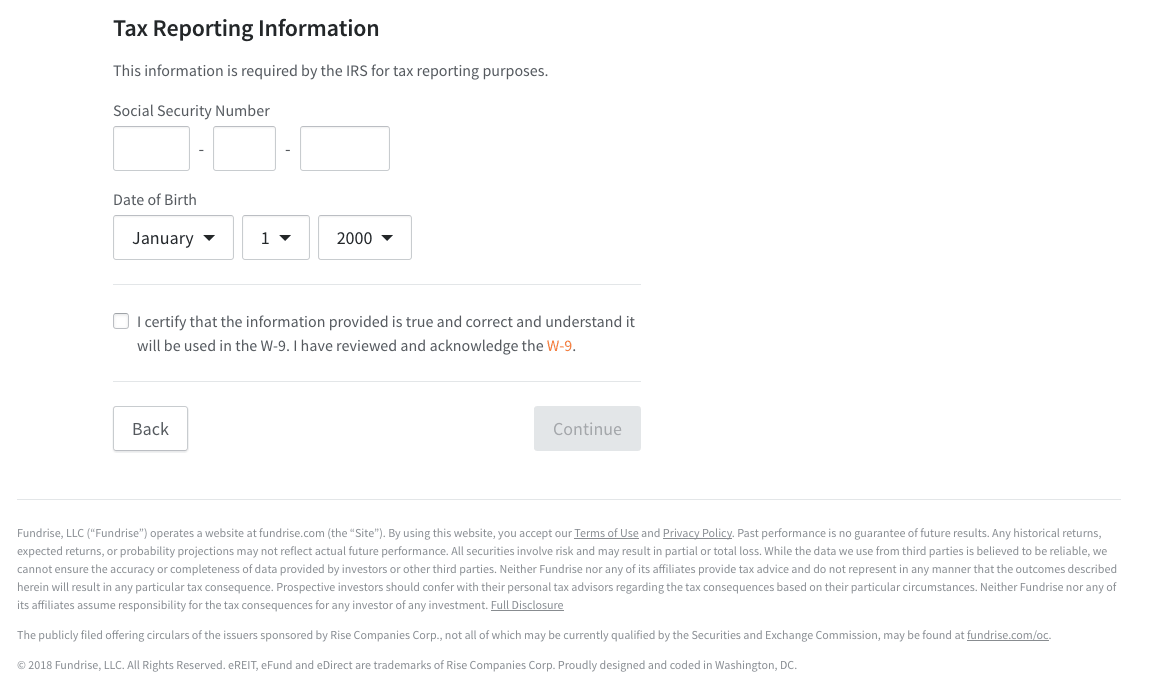

Next, we’ll add our contact information, including your social security number and birthday.

Next, we’ll decide how much we want to invest. The amount we choose to invest will affect our investments and asset allocation. Because we’re doing a $500 deposit, we default to the “starter” plan.

Then choose if you want to auto-invest.

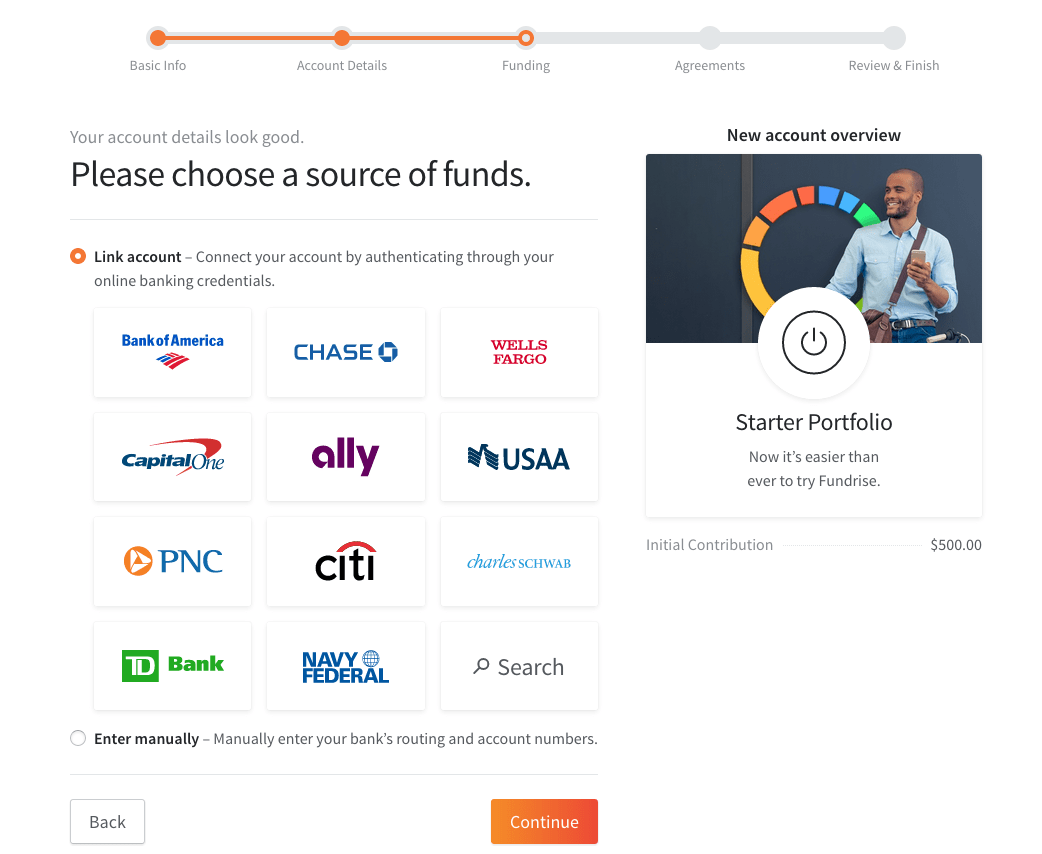

Next, choose a bank account to fund your account. Fundrise only accepts funds from banks. Link your bank and select your account.

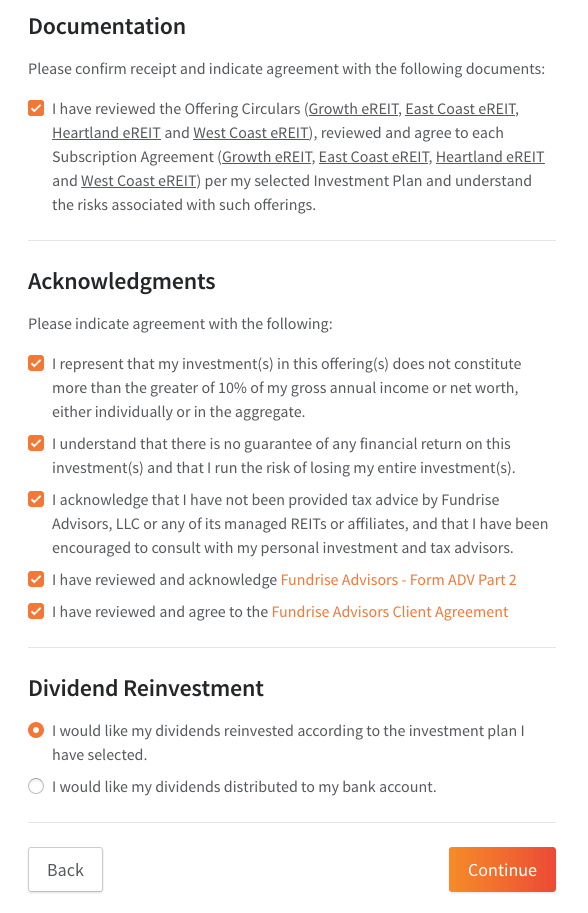

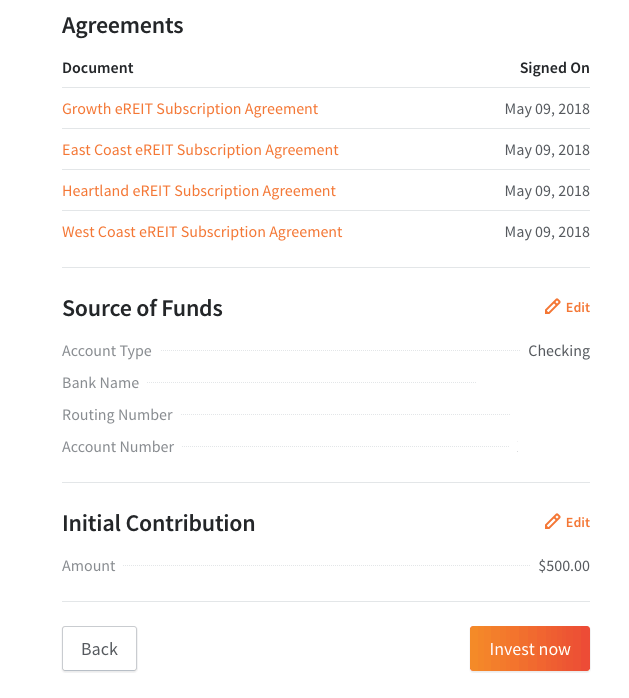

Next, we’ll receive some documents that would probably be prudent to read through before going further. It includes a circular for each of the eREITs you’ve purchased. These circulars contain anything you’d ever want to know about your investment.

You must also agree to some acknowledgments, such as “this investment doesn’t constitute greater than 10% of my gross income or net worth”, “that there is no guarantee of return” and “the complete loss of your investment is possible” – pretty standard stuff.

Next, we’ll check whether we want to reinvest our dividends. I think it is imperative to reinvest dividends in order to build our portfolio faster, but I have such a small investment that I may think about just taking the cash.

Review your information. If everything looks correct, hit “invest now“.

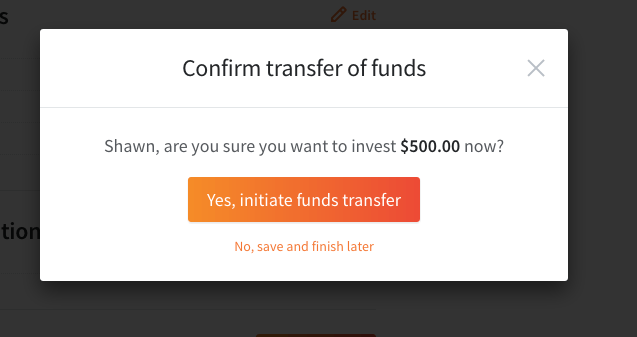

It will ask if you’re sure if you want to invest. Click “initiate funds transfer“.

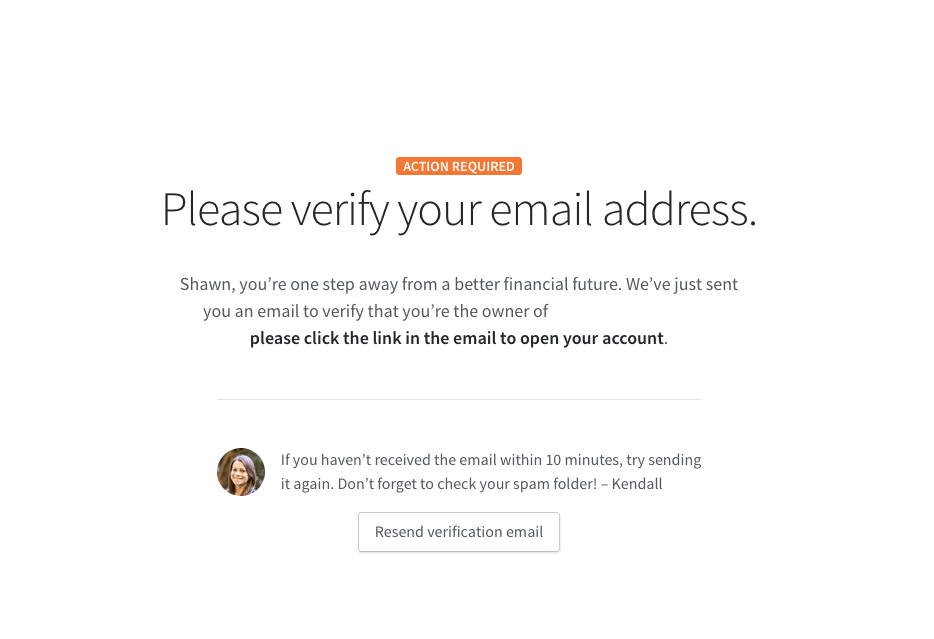

CONFIRM YOUR EMAIL

After you’ve signed up, you should receive an email confirmation.

You need to click on this email before your order will be placed.

After that, we play the waiting game. It’ll be at least a few days before your account is funded and recognized by Fundrise. You should receive an email from them once your account is funded.

LOG INTO YOUR ACCOUNT

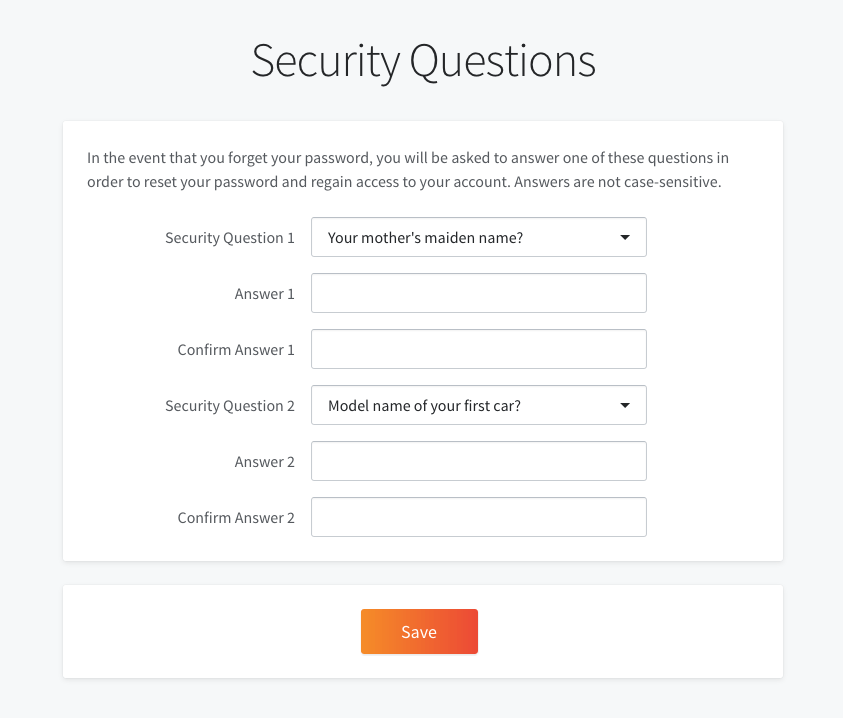

It will ask you to create three security questions.

Click “save” and you should be good to log in and be taken to the dashboard screen!

Note that it will take a few days for the funds to be deposited and show up in your account. Once that’s done, you can log in and check out your investment!

THE DASHBOARD

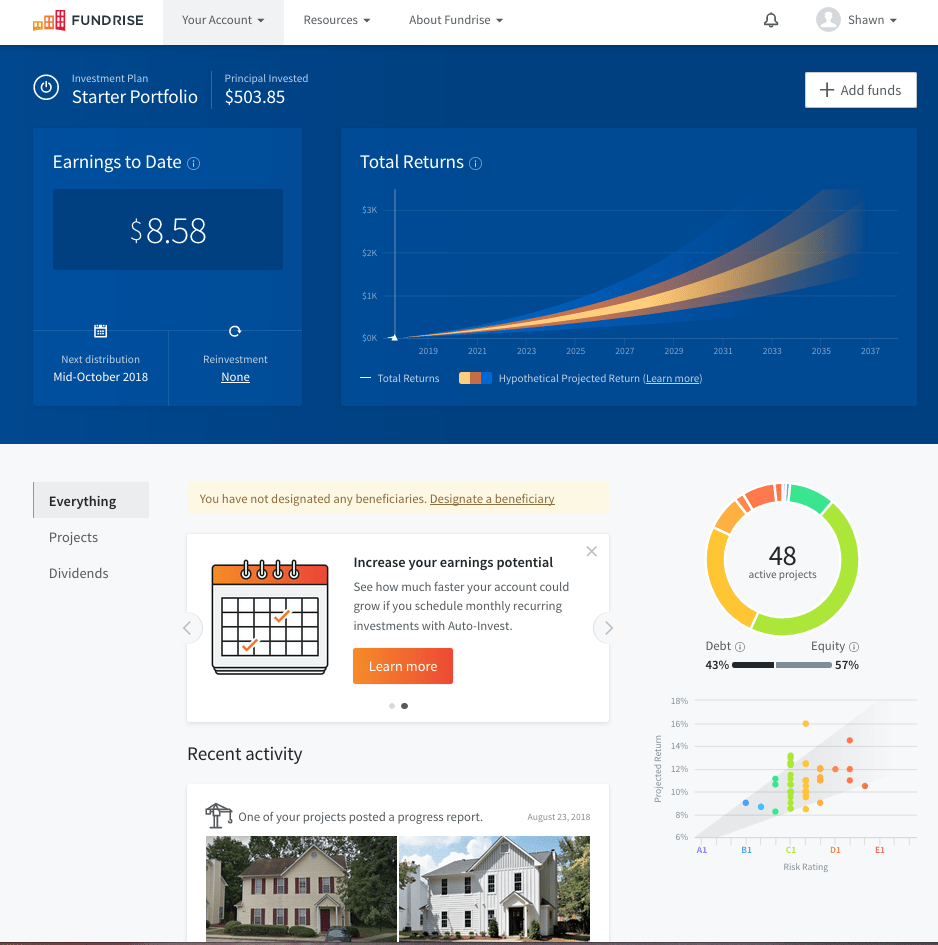

When you log in you will be brought to the dashboard:

Here you can examine your portfolio, check on your returns, view important documents, check recent transactions and more. There’s even a “recent activity” feed that gives routine updates on your properties.

BUT WHAT ABOUT VANGUARD?

But perhaps the biggest question we should ask is, “Why should I invest in Fundrise over a company like Vanguard?”

I am a huge fan of Vanguard. Most of my money is with them, in both a traditional IRA and Roth IRA, and in a brokerage account.

So why wouldn’t I just go with Vanguard? Don’t they have a great ETF?

While I don’t have much experience with Vanguard’s REITs, Fundrise has done us one better and compared their eREITs to Vanguard’s flagship REIT, VNQ.

Let’s examine the differences right where it counts: in returns and fees.

FUNDRISE RETURNS

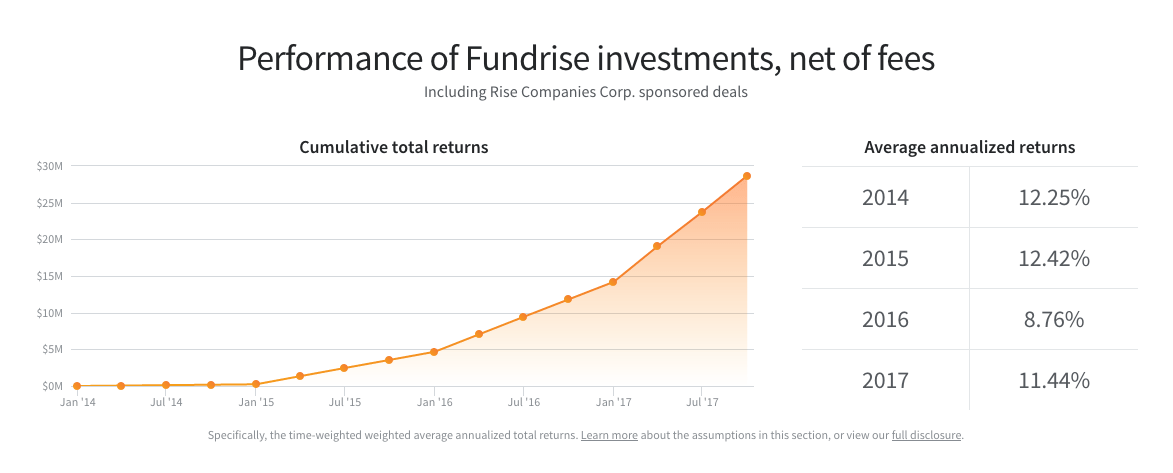

While the annualized returns for each year is pretty impressive, the average annualized returns over four years is 11.21% Not bad at all.

VANGUARD RETURNS

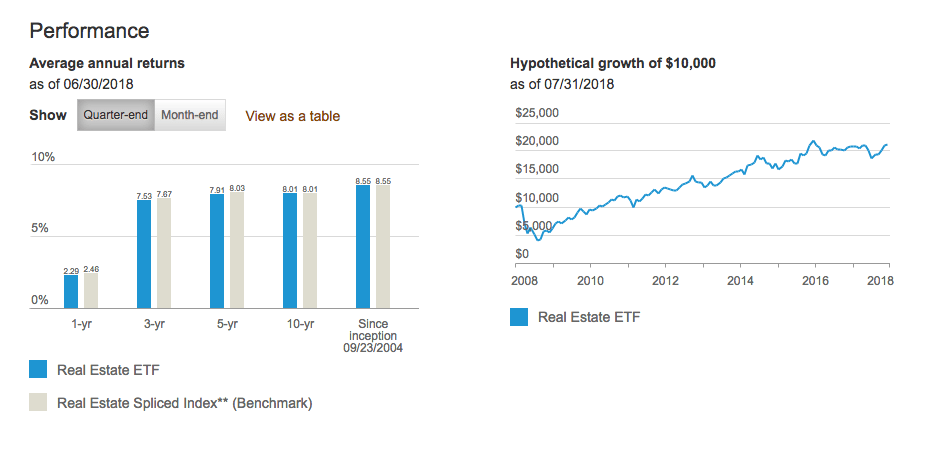

Vanguard’s average return numbers aren’t too bad, but their 5-year average is well below Fundrise’s, with a 5-year average of just 3.55%.

Contrast that to Fundrise’s four-year average of 11.22%.

Even with a ten-year average of 8.05%, that’s still less than Fundrise’s average.

While investing $10,000 would still be a good decision, investing in Vanguard over Fundrise the last four years would’ve seen you miss out on a gain of 2% to 3% per year.

Verdict: Fundrise edges out Vanguard in overall returns strictly looking at the numbers. Because the data Fundrise provides is limited, it’s hard to make an accurate call on which truly comes out ahead.

But going purely by performance, Fundrise wins.

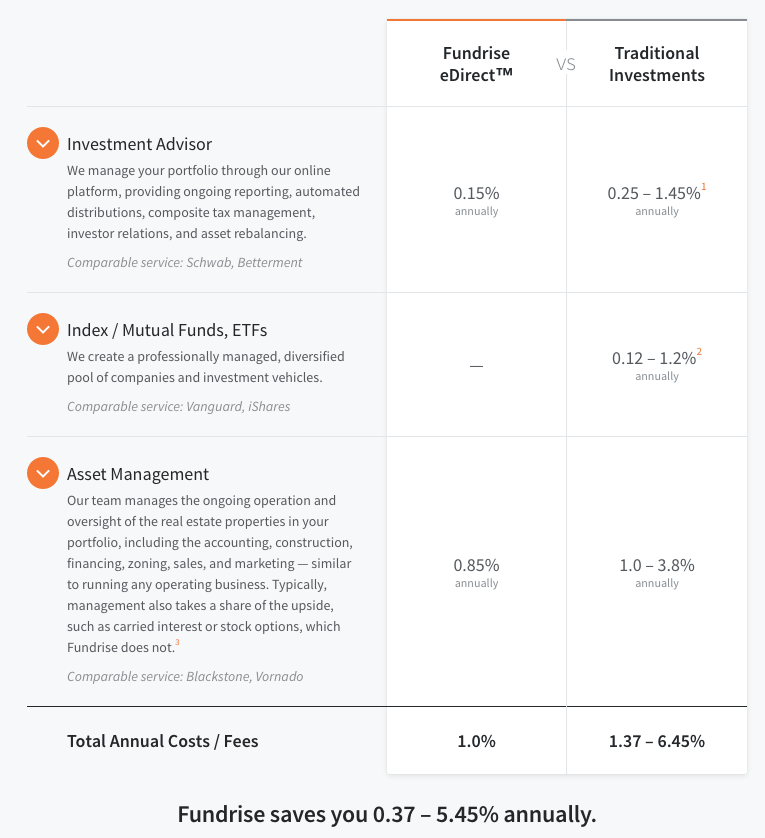

FUNDRISE FEES

Fundrise charges fees, like most index funds, for paying an advisor and managing your assets. In total, they charge 1 percent – 0.85% for asset management and 0.15% for the investment advisor. They do not charge any transaction or commission fees.

While their fees are lower than most, it’s still more than I’m used to paying, being a Vanguard ETF holder.

Still, Fundrise claims to have lower fees than most traditional investments.

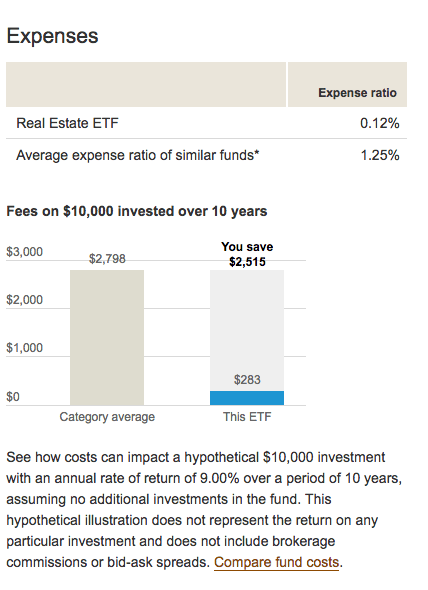

VANGUARD FEES

Vanguard also charges fees for their index funds, including a 0.12% asset management fee.

While there are no other fee listings on Vanguard’s site, Fundrise claims that an additional 0.30% fee is charged to manage the asset, but it looks like that’s only if you decide to have a personal advisor – which I don’t think is a necessity to own the stock.

Fundrise also claims that additional fees are directly built into Vanguard’s funds because there are so many people who have a hand in the stock before public investors (us) do.

Still, without seeing these additional fees listed out, it’s difficult to know who wins.

Verdict: Vanguard edges out Fundrise in terms of listed fees, but as we’ll see below, we don’t always know if it’s accurate.

FUNDRISE FUND STRUCTURE

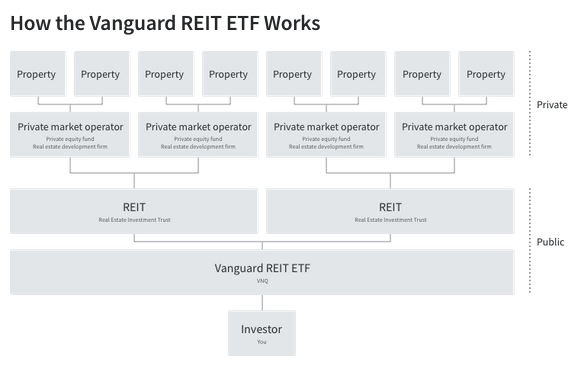

Typically, investing in real estate is done in one of two ways: by purchasing property directly, or by investing in REITs.

But investing directly in physical property has a large barrier of entry, including large deposits, hefty fees, etc.

And while REITs are great, one of their biggest downsides is their overall structure. By placing investors at the end of the supply chain, substantial fees become placed on us before we’ve even taken a look at the price.

Fundrise tries to mitigate this with the structure of their own eREIT.

Because Fundrise investors get in at a higher rung than their Vanguard counterparts, hypothetically, fewer fees are passed along.

VANGUARD FUND STRUCTURE

Notice how we’re at the bottom? That’s because crap runs downhill.

All of these people in the private supply chain had a hand in the investment before it’s even been sold to us. Additional fees are built into the prices we see, which are then levied with an additional management fee by your brokerage firm themselve. All of this is invisible, so it’s difficult to know exactly how much we’re paying in fees.

Verdict: Fundrise seems to have an edge over Vanguard in terms of overall structure, which supposedly saves us on fees, but without having complete access to information on fees, it’s hard to make the call.

SO WHO WINS?

The short answer is – I don’t know.

While Fundrise appears to offer greater returns, they also have a larger outward fee than Vanguard. Vanguard appears to have a lower fee, however, Fundrise claims that because of Vanguard’s REIT structure, there are more fees built in to the investment – but without having access to those numbers, it’s difficult for us to say whether that’s true.

CONCLUSION

So far, investing with Fundrise has been, well, fun.

It’s clear that Fundrise has some advantages over Vanguard, but Vanguard has some over Fundrise as well.

With Vanguard being such a heavy-hitter in the investing department, it’d be difficult for me to pass them up if I ever was seriously considering about getting into REITs.

For the time being, I’m sticking with my Fundrise eREIT.

While it’s such a small investment I don’t know if it’ll ultimately be worth it, I am glad that I tried checking it out.

I’d say it’s best to do your due diligence and go with whichever one you feel more comfortable, but, if you’re going to be investing a lot of money, I’d say it’s worth looking into Vanguard’s VNQ.

What about you? Do you have any REITs? Are you interested in Fundrise? Let me know in the comments!

– NMI

All information was gathered from Fundrise’s website. I have no affiliation with Fundrise and am not receiving compensation for this review. See my disclaimer for more information.

Leave a Reply