Welcome to the nineteenth net worth report here at NMI!

Sorry this one is coming so late!

My project with my client is just coming to an end, at least for a few weeks, and I had a lot of work I needed to finish up during the month of March, so it kept getting pushed off, and pushed off, and…now it’s April 😀

I’m pleased to say that February was another good month for my finances. The stock market has been steadily rebounding, and I seem to be getting consistent side income almost every month from multiple jobs.

I’m definitely happy with how things are going.

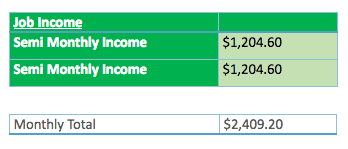

For those new to my net worth reports, I’d like to give you a few minor details. I get paid semi-monthly, which means I get paid on the 15th and the last day of the month.

Sometimes my money isn’t made available to me until two or three days after the month has already changed, so in order to ensure the most accurate net worth reports, I will always include both incomes. As such, my reports will be made available on the third or fourth day of the following month, possibly a few days after.

In rare circumstances in which I fail to get paid on time, I will either wait until that money is made available to report or I will include it in the following month’s net worth report.

You can find the latest and/or past reports here.

These figures are accurate as of the end of the day, March 10th (even though this is coming far after that) 😀

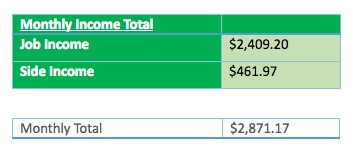

MY INCOME

JOB INCOME

We have definitely started to slow down at work, which really sucks. I’m not totally surprised as Winter is usually our slowest time, but we had a good December and January, so I was hoping to keep that momentum going.

I’m surprised with it starting to get warmer that there aren’t more people out.

And I wonder why I have a scarcity mindset 🙂

Even still, I got paid on time.

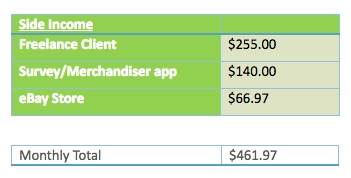

SIDE INCOME

For the tenth month since doing these reports I have some additional side income to report!

I didn’t make any money from my Etsy store nor the consignment store, but I did sell a piece on eBay and I got paid for some freelancing work I did for my client. I also did a store reset at an Ulta store for Survey.com on one of my days off.

I’m still trying to get a litter picking business started and I’ve yet to go through the course I purchased on doing Facebook ads for local businesses as a side hustle.

Not including my job, I made money from three different sources this month.

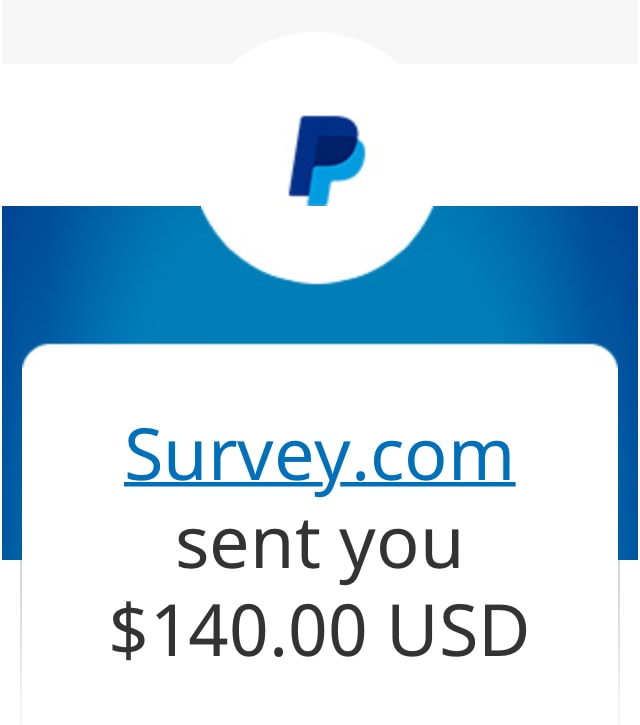

MERCHANDISER/SURVEY

I use the merchandiser app to do tasks for businesses, like restocking, doing store resets, etc.

I did a store reset at Ulta beauty on one of my days off and got paid $140 for seven hours of work, which is $20 an hour. I think that’s pretty damn good.

Those sorts of offers don’t come up that frequently, so I figured I had to jump on it. I really need to do more of them as they’re a good side hustle, but I don’t always feel like working on my days off, which is the only time I can really do it.

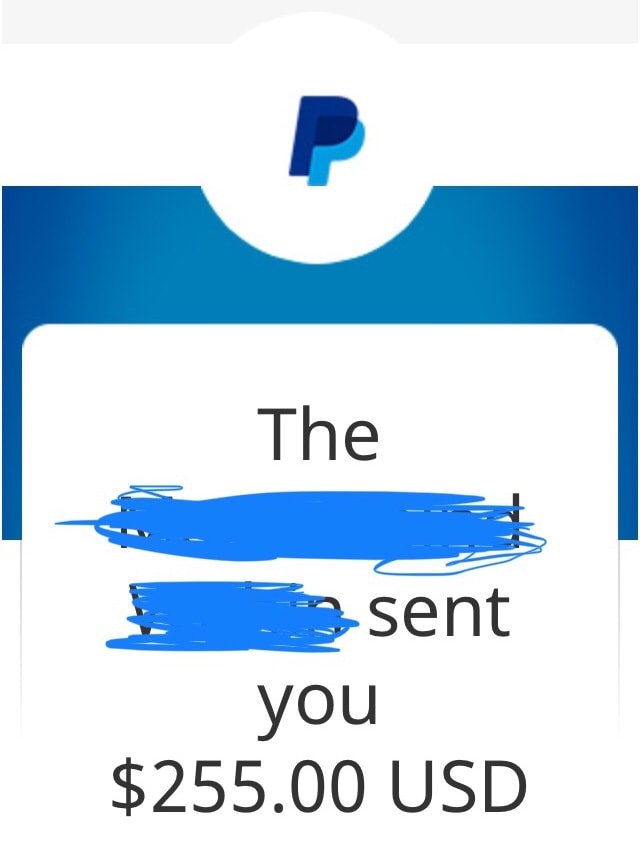

FREELANCE

My freelance job is going really well.

My client is super nice, laid back, pays me a good income, and I basically just complete work from a list of tasks at my leisure. I got paid $255 this month.

I was definitely a little lazier compared to the last few months. I was sick for a week, which put me behind, and I took a week off for myself.

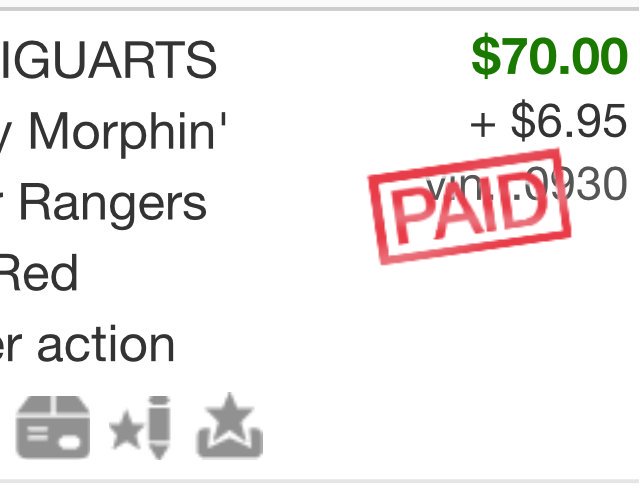

EBAY

I’m actually starting to run out of stuff to sell on eBay after my success with it over the last few months!

That being said, I still sold one item this month: a red power ranger figure for $70.00.

Overall, the merchandise sold for $76.46 total. Less eBay’s fees, which I figure I should keep track of, and I made $66.97.

CONSIGNMENT STORE

I haven’t really been selling much furniture lately, which kinda sucks. I’m hoping things start picking up a little bit. I also need to be on the lookout for more merchandise – I’ve been a little lazy when it comes to sourcing stuff. Fortunately, you’ll see I do have some success next month 😉

TOTAL SIDE INCOME

TOTAL INCOME

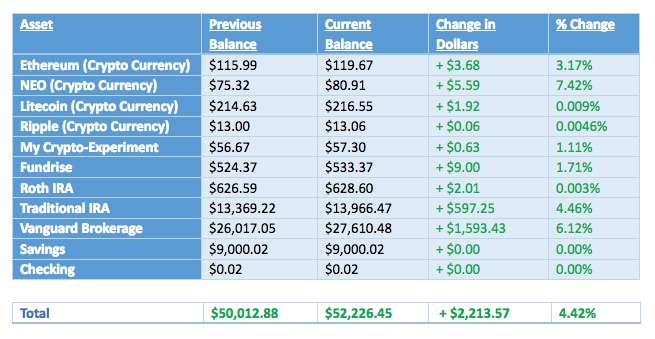

MY ASSETS

SAVINGS

I have been trying to put as much money away in savings as I can, as I keep hearing that a recession may be coming soon.

If you know a lot about investing (I don’t), then you’d know that the yield curve recently inverted, which has been known to signal a recession in the near future.

Of course, no ones knows when this could happen, but I figure I may as well prepare for it now.

INVESTMENTS

As you can see above, the stock market has been rebounding heavily. There have definitely been some volatile days with me wondering what the hell is going on, but, overall, things seem to be OK.

Crypto seems like it’s slowly coming back to life, and my Fundrise portfolio seems to be increasing almost every month too.

Remember, when it comes to crypto, never part with more money than you’re willing to lose! I’ve learned that the hard way!

Here’s a link to my article on cryptocurrency that every beginner should check out before jumping in.

*I decided to try an experiment in which I purchased 43 different cryptocurrencies (worth about $900.00 total) in the beginning of 2018 with the intent of holding onto them for one full year. You can check out the initial post here. I will be posting updates to that portfolio around the 15th of each month.

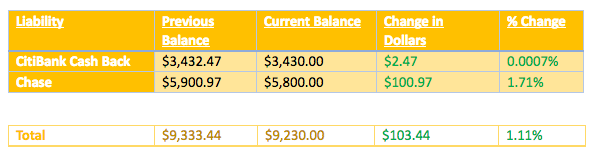

MY LIABILITIES

Fortunately, I didn’t really add much to my balances this month.

Still, I’ve found that it’s been difficult to get my debt paid down. I feel like I’m just kind of treading water and not making any real progress. I suppose it’s great things aren’t getting any worse, and some of that debt is from investing in product for furniture flipping, my Etsy store, etc., but still. I want this debt gone by the end of the year.

For now my main focus is paying off the Chase card, as that card’s 0% interest promotion will run out at the end of June.

I really recommend automating all of your bills, especially if they allow you to pay with a credit card. You set it up once and you don’t have to worry again. The only ones I don’t automate are accounts that need a checking account – you want to be sure the money is in there before it gets debited.

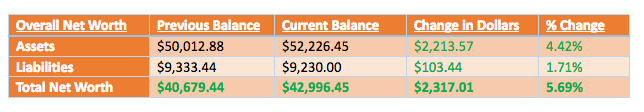

MY NET WORTH

An INCREASE of + $2,317.01!

Another sizeable increase! Mostly due to my investments increasing, but still!

I’m very happy that things are moving back in the right direction.

I’m actually pretty surprised at how quickly I seem to be gaining momentum. This will be especially apparent in next month’s report.

CONCLUSION

And that wraps up the second net worth report of the year! Expect the March report much sooner 😉

Hopefully in the next few months I’ll have some additional side hustles to reveal.

How is your 2019 going? Any new side hustles you’re working on? I’d love to hear!

– NMI

freddy smidlap

nice hustling. gotta get those card balances chipped away and you’re off to the races. that’s a nice size savings account in case you ever need it. you have it in a high yielding account?

by the way, the site works fine from my home computer. i must have some issue with the one at my work. keep plugging away, amigo.

Shawn

Hey Freddy, glad it’s working for you!

I don’t want to spoil next month’s report, but I had such a great month with extra income from getting my tax return and some side jobs that I just transferred $15,000 into a high-yield account I opened with Marcus last month! I’m already getting some good interest! 😉 My plan was to save one-year of living expenses before the end of 2019 and I have!

I’m hoping to take a good chunk away of those cards with the next two paychecks and start getting it paid down now that I have a decent buffer of savings.

Thanks for stopping by!

G@From One Geek to Another

Congrats on your growth!!!

Shawn

Thank you! 🙂

I need to pop over to your site and see how you’re doing!