This post may contain affiliate links. See my disclaimer for more information.

Three weeks ago, I did something radical – at least for me.

Being an all credit user, and being fed up with my ever increasing balance, I decided I was going to put myself on a cash diet for the rest of the month (the 15th to the 31st).

Here’s what I said about the idea of it:

This is not going to be easy, as I’m really not a fan of cash.

It’s dirty, clumsy, and kind of a hassle to carry.

And even with all that, as a super awesome bonus, it has trace amounts of drugs and pathogens on it.

It’s safe to say I don’t like using it.

I don’t even like touching it.

But I’m sick of my credit card balances going up, I’m sick of overspending, and I’m sick of having debt. So I’m going to try this out.

I figure if this works, I may start to use cash more frequently.

I’ll just keep extra hand sanitizer with me.

But i decided I was going to at least try it to see if it made any difference in my spending. I believe it did. But first, here’s a reminder of my two week budget.

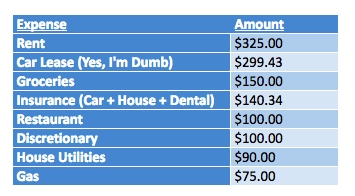

MY TWO WEEK BUDGET

My rent is paid at the beginning of the month, my car lease at the end, with insurance and utilities being automatically paid at the end of the month through auto-pay – so I don’t need to worry about pulling out cash to cover those.

This leaves me with just four other expenses I’d need cash to cover; groceries, gas for my car, restaurant visits and some discretionary spending.

To determine this amount, I simply totaled the amount of my budget for those four items, then divided that in half – leaving me with about $213.00. I rounded down to just a flat $200 to make it easy, and took the money out of my checking account on the morning of the 15th.

END OF WEEK 1

After the end of the first week, I was left with just $59.44 to last me the rest of the month.

Can I really make this measly amount last for nine more days?

Let’s find out!

WEEK 2

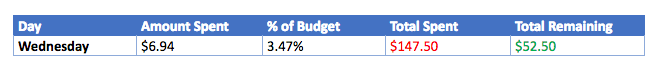

WEDNESDAY, MAY 23

After the obnoxious amount of tortilla chips and salsa I purchased last week, I was dedicated to finishing them off, so that’s what I had for lunch, together with an apple and some steak strips from our previous Costco binge.

For dinner, I had some Hungry Howie’s Pizza (love that cajun crust) with my brother, who offered to pay for it. I obliged. I saved half of my portion for lunch tomorrow.

The pizza was delicious but now I had a bit of a sweet tooth, so I decided to go to the nearby grocery store that’s conveniently located 500 steps from my door. I decided on making a chocolate ice cream soda, so I purchased some ice cream, soda water and chocolate sauce, for a total of $6.94. I figured I’d be able to get at least eight servings out of this, bringing the average cost of each serving down to less than a buck – way cheaper than going to the ice cream shop nearby.

Today’s expenses represented 3.47% of my overall budget.

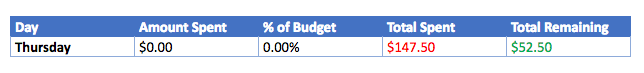

THURSDAY, MAY 24

I didn’t spend any money today! I ate the leftover pizza for lunch with an apple and then had breakfast for dinner, including some cereal, milk, toast, and some frozen fruit we had on hand.

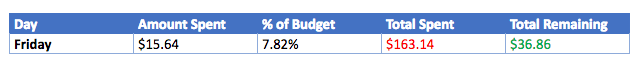

FRIDAY, MAY 25

I had some beef jerky, one of my apples and a $5 mocha for lunch.

We got pizza, again, at Little Caesars for dinner and I spent $10.64 on a pizza and some crazy bread. Obviously, we love pizza. Also, I’ll just tell you, we love pizza. This took a huge chunk out of my budget, but I only have six more days left. I think I can do it.

Today’s expenses represented 7.82% of my overall budget.

SATURDAY, MAY 26

I was so busy at work I hardly had time to eat so I just snacked on an apple and water. Like a horse. I know I’ve been keeping myself pretty anonymous here, so, here’s a recent picture of me:

For dinner, we had homemade hamburgers using frozen beef I’d vacuum sealed months ago and some brioche buns my brother bought and some frozen fries. They were butter burgers. If you’ve never had one, I suggest you try one, either making one or going to Culver’s, if you have one nearby. They’re some of the best burgers around.

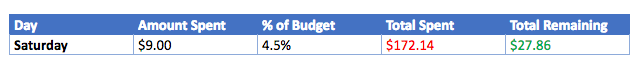

I did have to spend a little money on gas, so I put in $9.00 to last me the rest of the month.

Today’s expenses represented 4.5% of my overall budget.

SUNDAY, MAY 27

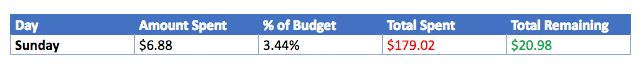

I bought some bacon, wheat bread and some margarine so we’d have some stuff to eat for breakfast, spending $6.88 total.

For dinner, we made homemade spicy chicken sandwiches, using the vacuum sealed chicken we had on hand, the rest of the brioche buns, along with some frozen french fries, so no money was spent there.

Today’s expenses represented 3.44% of my overall budget.

MONDAY, MAY 28

At work I had an apple and some chips and salsa for lunch, so no money spent there.

For dinner, we had deep-dish pizzas that my brother makes that are so. darn. good. Here’s a picture of what they usually look like:

I seriously don’t need anything else to eat if I can have one of these for dinner.

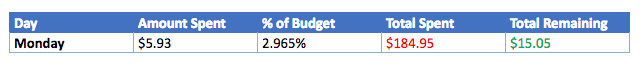

But I lie because I actually spent $5.93 on some more chocolate syrup, some milk, and soda water for chocolate ice cream floats. It being so hot, these are so refreshing to have on hand.

Today’s expenses represented 2.965% of my overall budget.

TUESDAY, MAY 29

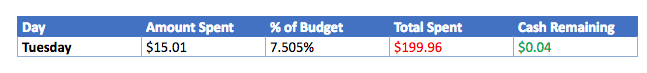

So, instead of going the next few days spending as little as possible, I figured I’d buy some stuff I knew I needed to just last me the next few days. I ended up purchasing some more tortilla chips, salsa, some tortillas in the event we were going to have chicken fajitas or tacos, a big bag of shredded cheese and some more ice cream, for a total of $15.01.

Wow, I have .04 to last me the rest of the month.

I hope I don’t spend it all at one place!

Today’s expenses represented 7.50% of my overall budget.

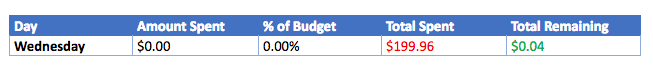

WEDNESDAY, MAY 30

I actually didn’t spend any money today! I’m sticking to it! It’d be so easy to just whip out my credit card and buy something, but I ain’t gonna. I’m finishing this month strong.

I had the day off so I ate at home, and for dinner my brother brought one of his famous barbecue chicken pizzas. So good!

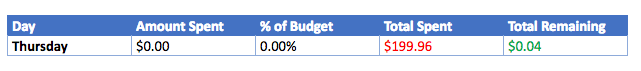

THURSDAY, MAY 31

For lunch I had chips and salsa and an apple, and for dinner we had another thin crust pizza from work. I’m spoiled – what can I say? But, because I didn’t spend any money today, that means I officially succeeded in completing my two week cash diet under budget!

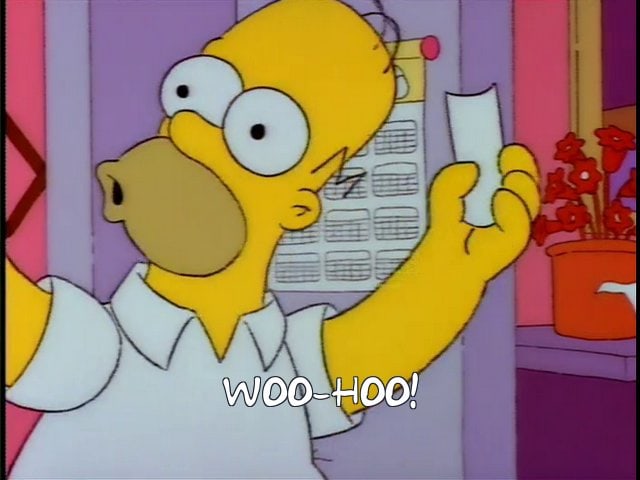

Woohoo!

WHAT I’VE LEARNED AFTER 2 WEEKS

MY SPENDING HABITS STILL REALLY SUCK & I CAN CUT THINGS FROM IT

At the end of the last week, I stated that I understood that my habits suck.

Unfortunately, I didn’t really do anything to change those habits this week.

They still suck.

$13.00 on stuff to make ice cream floats?

$10.64 on pizza, even though I already had it multiple times throughout the last few weeks?

What the heck?

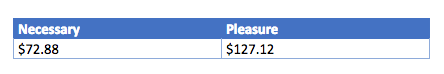

I decided to look a little closer and try to determine how many of my purchases these last two weeks were truly necessary.

I figured I could deem purchases necessary if they’re items I need to live my life, like gas so I can get to work; groceries staples like apples, pasta and shredded cheese; or goods needed for my Etsy store.

The purchases I deemed a pleasure was anything that isn’t necessary to live, such as pop, candy, and other sweets.

The results even surprised me.

According to my calculations, I spent about $72.88 on necessary items, and about $127.12 on discretionary purchases. That means almost 65% of my spending was on things I don’t need.

That’s really bad.

Clearly, there are a lot of things I could cut from my budget.

AT LEAST I CAN STICK TO A BUDGET

While I’m not totally proud of all the crap I spent my money on, I am proud that I actually came in under budget.

I wasn’t really sure if I could do it.

I don’t keep the greatest track of my spending throughout the month when I use my credit card, so spending money with just cash was a little different for me.

I seemed more aware of what I was purchasing and most days, I think I generally tried to keep my purchases low. I even went three days without spending anything, which is great. I need more “no spending” days.

While there’s a lot of money I could save by cutting the superfluous stuff from my spending, I realize that’s not the only reason I’m able to save money.

HAVING FAMILY, A PARTNER, OR A ROOMMATE CAN HELP

Living with an additional person who’s able to contribute to the household bills, whether that’s necessities like gas and water or extra stuff like food and Netflix, can ease the burden of high bills and is tremendously advantageous.

The fact that I live with my brother and we can contribute to rent, bills and groceries together really makes a difference in my finances. If I was financially responsible for every single thing for myself, including meals, I wouldn’t be able to so easily spend money on junk.

I should probably keep that in mind more often. The fact that I can save more because I split the bills with someone should be all the motivation I need to save it rather than spend it.

I’m also lucky to be able to get free food multiple times a week from my brother’s sub shop. That definitely saves me money.

AFTER THE DIET

I’ve continued to utilize a mostly cash diet for the last couple of weeks and it’s been going well. I’ve been using the same amount of cash, $200.00 every two weeks, and while there are times in which I feel constrained, I think that that’s a good thing.

CONCLUSION

Participating in an all cash diet has been a rewarding experience.

I’ve recognized my tendency to overspend on things I don’t need, and I’m committed to making a lasting change. I’m glad that I proved to myself that I can avoid the use of credit cards, and that I can choose to spend less if I really want to.

I think the most important part is recognizing that not depriving myself of the things I want and overspending don’t have to go hand in hand. I can do it reasonably.

I can have some of the things I want, but not all of them.

That’s a good rule to live by.

What’s your main method of spending? Do you like cash or credit? A combination of both? Have you ever put yourself on a restrictive budget, and has it helped?

I’d love to hear!

Leave a Reply