This post may contain affiliate links. See my disclaimer for more information.

I love using credit cards.

They’re easy to carry, easy to use, accepted pretty much everywhere – and they aren’t nearly as filthy as cash.

Unfortunately, this ease of use has come with some drawbacks. Namely, that I use my credit card way too often.

I use one card for pretty much all of my expenses throughout the month, whether that’s for automated bills or everyday things. While it’s great to have a running tab tracking all of my expenses, I’ve found that I’ve become somewhat absent-minded in my day-to-day purchases.

Sometimes I don’t even look at the total screen. Spending money has become kinda automated.

This is not a good mindset to have in life and it spells disaster for your finances.

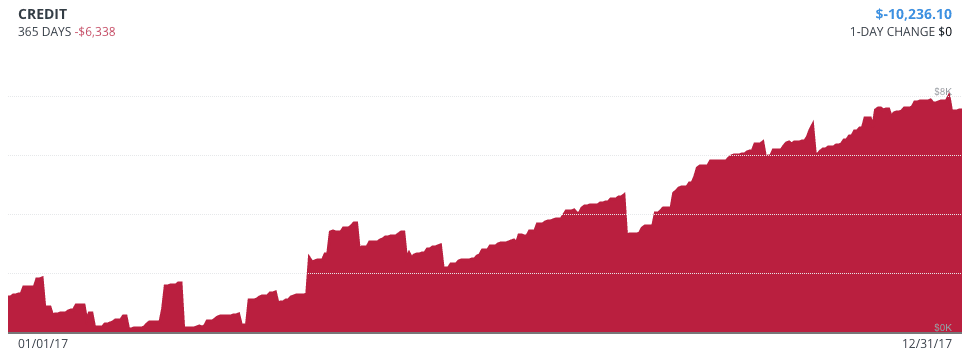

Just look at my ever-climbing credit card balance for an example of that:

Yikes.

I decided I needed to rein this in and stop it now.

I was going to be more mindful of my spending.

While the sentiment is great, how exactly does that help me?

The common notion is that people generally spend more when they use a credit card as opposed to using cash.

I imagine most credit card users fall into this category, including myself.

A credit card is almost like an unending wallet of money that can be used on whatever you want, whenever you want, wherever you are. They come with practically no limitations besides what you can spend. It’s easy to see how people can let it get out of hand.

With cash, however, you are holding a finite amount of tender. If I have $100 in cash, I have $100 worth of spending power. The cash I have in my wallet is the only money I have that can actually pay for something right now without owing anyone further.

If $100 is the only money you have in your wallet, then $100 is a lot. Watching it slowly dwindle down over time, I believe, makes one more cognizant of their spending.

I’d heard of people using an all-cash system in which they carry cash around for their various expenses, and once it’s gone, it’s gone. You can’t spend anymore money because you don’t physically have it. You don’t overspend because you can’t spend money you don’t possess.

This idea seemed interesting to me, so I decided I was going to ditch the card, and…

I’m going on a two-week cash diet.

This is not going to be easy, as I’m really not a fan of cash.

It’s dirty, clumsy, and kind of a hassle to carry.

And even with all that, as a super awesome bonus, it has trace amounts of drugs and pathogens on it.

It’s safe to say I don’t like using it.

I don’t even like touching it.

But I’m sick of my credit card balances going up, I’m sick of overspending, and I’m sick of having debt. So I’m going to try this out.

I figure if this works, I may start to use cash more frequently.

I’ll just keep extra hand sanitizer with me.

MY TWO WEEK BUDGET

I’m starting this diet on the 15th of May, which means I only need to cover half of the month’s expenses.

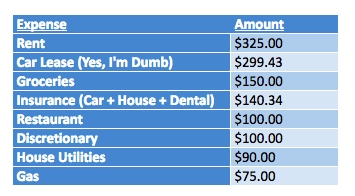

Here is a reminder of what my monthly budget looks like:

My rent is paid at the beginning of the month, my car lease at the end, with insurance and utilities being automatically paid at the end of the month through auto-pay – so I don’t need to worry about pulling out cash to cover those.

This leaves me with just four other expenses I’d need cash to cover; groceries, gas for my car, restaurant visits and some discretionary spending.

To determine this amount, I simply totaled the amount of my budget for those four items, then divided that in half – leaving me with about $213.00. I rounded down to just a flat $200 to make it easy, and took the money out of my checking account on the morning of the 15th.

THE PLAN

My goal is to have this money last me for the rest of the month.

Whatever the expense, whether that’s for gas, food, or something else that comes up, I’m going to pay for it with cash, trying to stretch this $200.00 to the max. I expect it to hurt.

I’m hoping that relying on just this cash will force me to make tougher decisions regarding what I want to spend my hard-earned money on. Do I really want to spend $5 on a latte, thereby using 2.5% of my two-week fund on a completely disposable item? I’m hoping no.

I’ll be reporting my spending on every day during this two week period, noting the days that I didn’t spend any money and the days which I did, and talking a little about my thoughts during each.

The entire first week will be available at the publishing of this post, while week two will be published, along with my thoughts of the whole experience, in early June.

WEEK 1

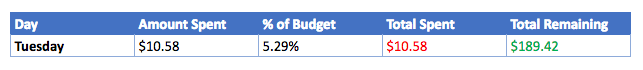

TUESDAY, MAY 15

I ate an apple and some mini cookies for lunch that I had purchased last week, so no money was spent there.

Then, for dinner, I spent $10.58 on groceries, including lettuce, pasta sauce, croutons, Italian dressing and a bottle of red wine.

Seeing as this represents 5.29% of my overall budget for the rest of the month, I gotta say, I’m a little nervous. While a couple things I bought today were staples and can be used again in the future, I’m still going to have to watch my spending, as spending much more than $10 a day is going to totally break my budget.

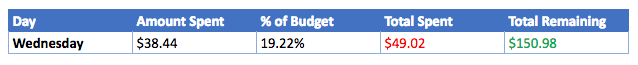

WEDNESDAY, MAY 16

As Wednesday is one of my days off, I generally get lunch somewhere, or go out and do something. Today I didn’t do a whole lot, but I did spend $8.43 on McDonald’s to try one of their new fresh beef burgers in a meal. Not worth it.

In the evening, I noticed I needed a couple other things for a recent Etsy store sale, so I did purchase some butter, a spice pack and a bottle of wine with my cash, spending $10.01. I also had a discretionary purchase of $20.00.

Today’s expenses represented 19.22% of my overall budget. A few more days like this and that money will be gone in no time. I need to try to be rational with my spending, though some things, like spending for my Etsy store, are unavoidable. The wine, of course, is too 🙂 .

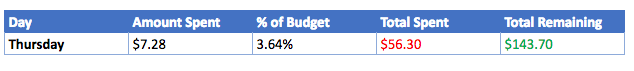

THURSDAY, MAY 17

I purchased some chips and salsa for $7.28 so I can have a snack at work besides just apples, so that should hopefully last me a few days.

I didn’t spend any other money as my brother brought me a sandwich to eat from the sub shop he co-owns. Getting food occasionally from his work definitely saves money. I’m lucky in that way.

Today’s expenses represented 3.64% of my overall budget.

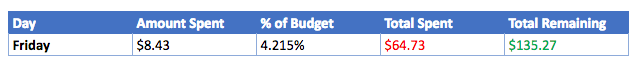

FRIDAY, MAY 18

Yesterday, when I purchased some chips and salsa at the store, I was forced to go with another kind because the type I was looking for couldn’t be found. Of course, today, I found these other chips I was looking for, and…I bought them. I also bought another cheap jar of salsa.

Double dipping isn’t exactly frugal, but I figure I’ll keep one at work and the other at home, and they should both last awhile. I also bought a $1 box of mini cookies and a half gallon of milk to snack on at work. I spent $8.43 total.

Today’s expenses represented 4.215% of my overall budget.

SATURDAY, MAY 19

I’ve been spending a lot of money lately, so I was firm in the idea that I would not buy anything today. And I didn’t! I need to have more “no spend days”. It’s hard though. Like most people, I like the thrill of spending money, even if it’s just a small purchase.

Today’s expenses represented 0.00% of my overall budget.

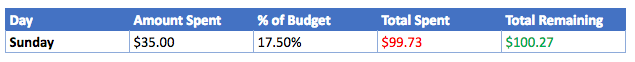

SUNDAY, MAY 20

I hung out at my dad’s house for the day, which was great. Saw some family and didn’t spend any money. Until I remembered I needed to pay my brother back for a few things he recently got at Costco, including cat litter, paper towels, and a few other things.

Boom. $35.00 gone – just like that.

Today’s expenses represented a whopping 17.50% of my overall budget. Now spending like this is what will really sink my budget.

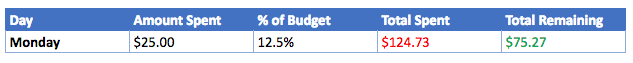

MONDAY, MAY 21

I needed gas this morning, so I spent $20.

I was super tired, so I also spent $5 on a mocha from the local coffee shop. So not only am I spending the little amount of money I have on luxuries, I’m also contributing to the failure of my latest minus month challenge.

Today’s expenses represented 12.5% of my overall budget.

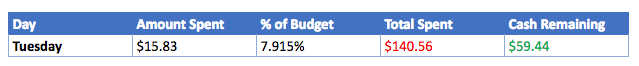

TUESDAY, MAY 22

I spent $12.63 on ten apples that should last me the rest of the month, and some bean tortilla chips that were on sale. I’m really not as obsessed with chips as this week might tell you – they just caught my eye. Not worth it for them, especially when I have other chips to eat. I also spent $3.20 on a couple of cokes from the gas station.

This is one of those stupid things that’ll wreck your budget. Over buying and over spending on things that you really don’t need. Looking over my last week of spending has pretty much made that clear.

Today’s expenses represented 7.915% of my overall budget.

Yipes. Eeep.

Whatever sound you use to express exclamation, I’m using it, cause I have less than $60.00 to last me the rest of the month. That’s less than seven dollars a day over nine days.

Fortunately, I’ve learned a few things that I’m hoping will help.

WHAT I’VE LEARNED AFTER 1 WEEK

MY SPENDING HABITS SUCK

Looking back over the last couple of days, seeing exactly what I purchased and for how much, it’s clear that I don’t mind blowing my money on stupid $hit.

When I was thinking about doing this experiment, I figured that just doing it would be a positive thing – as long as I stayed within my budget, I would be proud.

I don’t really feel that way now.

Looking at my purchases throughout this last week, most of them are totally unnecessary, and many of them have no real value.

While I did purchase some staples, like milk and apples, and some household goods like paper towels and cat litter, most of my other purchases were stuff that I would categorize as wholly unnecessary.

Things like fast food. Cookies. Pop. Snacks.

I actually purchased three different bags of chips and two different kinds of salsa in one week! Why? What a stupid thing to do and what a waste of money.

This week has shown me how dumb I can be with my money sometimes.

These are the things I need to avoid if I’m going to make it through the rest of the month. Actually, this is the sort of thing I should just avoid doing altogether, always, cause it’s such a budget buster.

Now that I recognize my spending patterns, this means I can do things to avoid them.

BUT I AM THINKING ABOUT THEM MORE

Seeing my spending habits laid out like that is a little embarrassing, but now that I see them, I can do something about them.

And one thing I’ve caught myself doing more is thinking about my purchases, both before and after.

Before buying something, I’ve been trying to think about the item’s price, whether I would get a good value out of it, whether it’s necessary, and whether it’ll get totally used.

For example, on Monday, when I was buying stuff to make spaghetti and a salad, I specifically purchased the cheapest tomato sauce they had, and sought out other items that were on sale. When I was scanning the section of croutons, I made sure I got the cheapest one listed. When I was picking out a dressing, I went with the store brand kind – cheap but still delicious. Knowing that I’m getting these items at a good price and that they’ll last for multiple uses makes me comfortable with their purchase.

I’ve also been trying to analyze my purchases after I’ve made them. For example, after I purchased the bean chips – also known as the third bag of chips I bought this week – and was let down by their taste and texture, I recognized that it doesn’t always make sense to buy something new just cause you want to try it.

THIS IS HARDER THAN I THOUGHT IT’D BE

I really underestimated how difficult this was going to be.

Because I’m used to using a credit card, and am in pretty good financial shape, I don’t worry that much about money. If I want something, and it’s small, I’ll usually buy it. If something springs to mind that I think I need, I grab it.

That thinking had to change with this cash diet.

Because I limited myself to a specific amount of money, I was forced to pay attention to exactly how much money I was spending each day. Instead of just buying whatever I wanted on a whim, I had to make decisions, and sometimes that meant sacrificing something (not that you’d really notice from looking at my spending).

It’s also been difficult seeing my spending choices actually have ramifications.

Generally, if I buy something stupid and I end up regretting it, I quickly push it to the back of my mind and try not to worry about it. The fact that it’s on my credit card and isn’t due right away helps me get away with this. With cash, that’s not so easy. If I spend $10 on something and it sucks, that’s 5% of my budget. That’s a lot of money to waste, and it’ll likely make me think of not doing it again.

PUTS MY LIFE INTO PERSPECTIVE

Going on this cash diet has helped put into perspective just how lucky I am to be in my financial position.

There are many people around the world who must rely on less than $100 a week, and they don’t have a credit card or fifty grand stashed away in investments that they can use if they have an emergency.

For many people, $100 a week is the only money they have to run their entire lives.

Many people have to worry about food, how they’ll get to their job, how they’ll pay rent. They wonder if they’ll have enough food to feed their kids.

I’ve never had to worry about that.

You know what’s a frequent worry in my house? If we made or ordered enough food, because we are people that like to eat.

Truly a small problem to have compared to most people in this world.

CONCLUSION

Going on a two week cash diet has been good for myself, both personally and financially. I’ve learned a few things about my spending habits, and I’ve even implemented a couple changes to them.

I’ve got about $60 to last the remainder of the month. While I don’t know what lies ahead for the rest of this cash diet, I really want to make this work.

I believe I’m going to have to utilize a couple of “no spend days” next week, in the hopes of stretching this money as far as it’ll go.

Have you ever gone on a cash diet? Or do you just use cash in general? What do you do to curb your spending? Let me know in the comments!

Leave a Reply