Welcome to the thirteenth net worth report here at NMI!

This one comes a little later than usual, but that’s because my finances changed pretty dramatically throughout August and into September, and I was trying to give myself a little break 🙂

I took out a big part of my savings and put it towards a big part of my debt. I also made some decent side income this month, with the sale of a piece of furniture at the consignment store, and a couple of sales from my Etsy store.

Let’s get into the details!

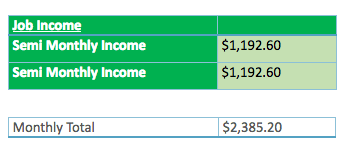

For those new to my net worth reports, I’d like to give you a few minor details. I get paid semi-monthly, which means I get paid on the 15th and the last day of the month.

Sometimes my money isn’t made available to me until two or three days after the month has already changed, so in order to ensure the most accurate net worth reports, I will always include both incomes. As such, my reports will be made available on the third or fourth day of the following month, possibly a few days after.

In rare circumstances in which I fail to get paid on time, I will either wait until that money is made available to report or I will include it in the following month’s net worth report.

You can find the latest and/or past reports here.

These figures are accurate as of the end of the day, September 23rd.

MY INCOME

JOB INCOME

I got paid on time again this month. Summer was actually kinda slow, but we’ve picked up right at the beginning of September, which is great.

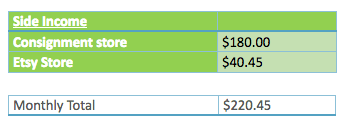

SIDE INCOME

For the fifth month since doing these reports I have some additional side income to report!

My Etsy store sold $40.45 worth of merchandise in August.

While it’s not a ton of income, it is a nice little bonus to have pop into my bank account every couple weeks. I’ve been trying to save anything that’s profit into one savings account, and putting the cost back into checking so I can use it to pay bills.

I’m also happy to report that I’ve finally been selling some of my furniture from the consignment store! I sold this beautiful Henredon campaign style chest for $200 cash!

I was off that day, and my coworker (who is also one of my best friends) told me someone was interested in it, and suggested going lower if they pay in cash. It was priced at $250, so I said, “Let’s try $200.” and it worked! She bought! I gave $20 to my coworker who helped facilitate the sale and kept $180. Considering it cost me less than $60, it’s a profit of $120!

Again, I put the profit in one savings account and put the rest into checking to pay the bill.

All in all, I’m pretty happy with how my side hustles are going. While I’d love to be making even more money, the fact that it’s working at all makes me happy.

Still, I have a couple other things I’m trying out in the hopes of bringing in a little extra cash.

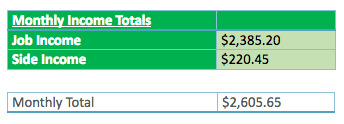

TOTAL INCOME

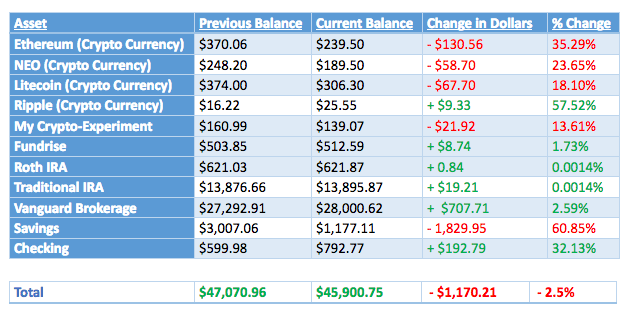

MY ASSETS

SAVINGS

At the end of August, I decided I was so sick of staring at my ever increasing credit card balance that I decided to put a huge chunk of my savings towards that – $4,338.69 worth, to be exact! You wouldn’t know that from the table below because I’m writing this report in late September, so it’s including some of my income from September.

Bad blogger, BAD!

But I couldn’t help it – taking out such a huge chunk of money and having it missing from my assets in that report would have been too painful 😉 .

INVESTMENTS

August was a good month for my investments. Crypto is, unsurprisingly, down, but the rest of my portfolio is doing pretty well, in particular VTSAX.

Remember, when it comes to cryptos, never part with more money than you’re willing to lose! I’ve learned that the hard way!

Here’s a link to my article on cryptocurrency that every beginner should check out before jumping in.

*I decided to try an experiment in which I purchased 43 different cryptocurrencies (worth about $900.00 total) in the beginning of 2018 with the intent of holding onto them for one full year. You can check out the initial post here. I will be posting updates to that portfolio around the 15th of each month.

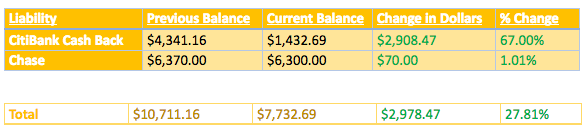

MY LIABILITIES

YES! I’m actually doing it!

I’ve been talking about getting rid of my debt for so long, but I never really pulled the trigger – until later this month. I had been thinking about taking some money out of my savings to just get rid of it, but I was worried about not having enough money to cover an emergency (even though I’ve never had to use it). I decided to say “to hell with it” and just took out $4,000.00 and paid CitiBank. Seeing a third of my credit card debt disappear in front of my eyes was a huge relief. It felt like I immediately regained a little bit of control.

My goal now is to have the CitiBank card completely paid off by the end of October. Because I did lose such a big chunk of assets though, I also want to continue to put a little money away in savings. My hope is that after the CitiBank card is paid off completely, I’ll start using cash for most of my purchases, with only automated bills going on the card. This way I can monitor my spending completely. I’ll probably try to use the same system I did for my two-week cash diet, where I set aside specific amounts of money for every week.

I really recommend automating all of your bills, especially if they allow you to pay with a credit card. You set it up once and you don’t have to worry again. The only ones I don’t automate are accounts that need a checking account – you want to be sure the money is in there before it gets debited.

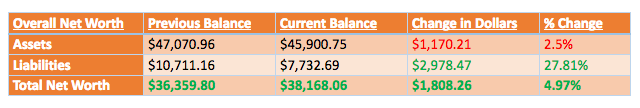

MY NET WORTH

An increase of + $1,808.26!

Wow. That’s awesome.

I suppose the results are a little skewed because this report comes well into the month of September, but I am pretty surprised at how paying that big chunk of debt seemed to finally help “unstick me”. I’ve been hovering around a $36,000.00 net worth for months, trying and trying to get over that hump, but nothing was working. Saving more cash was moot when I just kept charging everything to cards. I wasn’t progressing, so paying that big chunk really seemed to help me move forward – now hopefully I can keep this momentum going.

CONCLUSION

While I didn’t want to do it at the time, paying that debt off was probably the best thing I’ve done for my finances in a long while. It’s righted a somewhat lopsided ship, and as long as I continue my track towards paying the debt off, there should be smooth sailing ahead.

It’s hard to believe we’re almost in the last quarter of the year! How’s your 2018 going? Ready for 2019? (I can’t believe I’m saying that already)

freddy smidlap

nice job on that credit card debt. you want to get out ahead of that one. i have one asset question. you have a rather large brokerage balance but not much in the roth. wouldn’t you want to maximize the roth for the tax free gains in retirement? it’s good to see somebody writing about the process from the near zero starting point. i’ve been where you are and it surely can be done, even by a wine drinking bon vivant like me.

my 2018 is great for the portfolio…so far. the end of work feels near.

Shawn

Thanks Freddy! I’ve been using a traditional IRA because it helps me get a big chunk back during tax time, which I immediately save/invest, so I look at it as helping me to get to FI sooner. I also save way more than $5,500 a year, so I’ve just been dumping as much money into my brokerage account as I can. Knocking that debt out for good is high on my list too, but I’m kind of cash poor right now, so I’m trying to balance paying off debt with saving.

2018 has been pretty great! I’m happy to hear you’re near the end of work – that’s an awesome milestone. I’d love to know when you finally take the plunge. Thanks for commenting and sharing!