This post may contain affiliate links. See my disclaimer for more information.

Let’s cut the cutesy intros and get right into the nitty gritty, eh?

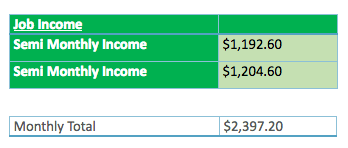

Because this is my first report, I’d like to give you a few minor details. I get paid semi-monthly, which means I get paid on the 15th and the last day of the month. Sometimes my money isn’t made available to me until two or three days after the month has already changed, so in order to ensure the most accurate net worth reports, I will always include both incomes. As such, my reports will be made available on the third or fourth day of the following month, possibly a few days after. In rare circumstances in which I fail to get paid on time, I will either wait until that money is made available to report or I will include it in the following month’s net worth report.

As of right now, I don’t have any previous net worth reports you can look at, but you can always find the latest and/or past reports here.

These figures are accurate as of the end of the day, September 3rd.

MY INCOME

JOB INCOME

I didn’t earn any extra income this month through side jobs/hustles, but I did have to stop paying city taxes for the rest of the year, which made my second check (and all future checks) just a tiny bit higher this month.

MY ASSETS

SAVINGS AND INVESTMENTS

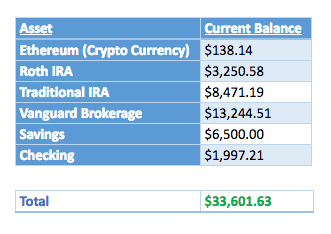

My assets didn’t change that much in August. I did use a little of my savings to pay down part of my credit card debt. I also bought some shares of various stocks through the Robinhood investing app, but I didn’t hold onto them for very long – I sold them after just a few weeks. Two important notes: 1) I made a whopping $0.29 cents and 2) I learned that dividend investing isn’t really for me. I love getting dividends – I do from all of my ETFs – and think they’re an important part of investing, but they’re just not a focus for me. I’m also too lazy to keep up with a hundred different stocks or so; I’d rather just deal with one or two ETFs and let ’em ride.

I also sold and cashed out a little bit of my Ethereum cryptocurrency in August, partly so I could be sure that the debiting/withdrawing function of Coinbase’s website was working correctly, and also cause I made a little money and wanted to put it back into my savings.

*Coinbase is the source I use to purchase all of my cryptocurrency. Here’s a link to my article on cryptocurrency that every beginner should check out before jumping in.

MY LIABILITIES

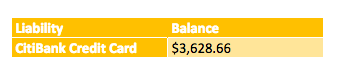

This is the only credit card I use and I use it to pay for pretty much everything, besides rent and my car payment.

I’m not particularly happy or proud of that balance, so my main focus is to save a little of each paycheck and devoting the rest to taking the debt out.

After I pay off the credit card debt, my focus will then be to save a little money while investing the rest, and avoiding all other consumer debt.

MY NET WORTH

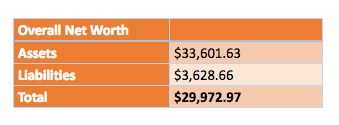

I don’t think that’s half bad! While I certainly won’t be having any money fights anytime soon:

I still feel like I’m making some progress (albeit small progress) towards my goal of reaching financial independence. Sometimes it seems like it’s going at such a slow pace, but I feel like getting to (almost) a $30,000.00 positive net worth is a pretty big deal! I still need to work on getting a few side businesses going. I have a couple ideas bouncing around in my noggin – hopefully I can get these implemented soon.

I’ll be using this net worth report as the baseline for all future reports. Check back every month for an update on my net worth!

Jesse

Nice work. Keep up the hard work. FYI you get paid semi-monthly (24 times a year). Bi-weekly would mean 26 checks per year. Just don’t want to see you get your plans messed up.

Why do you carry the balance on the credit card?

Do you use Robinhood for investing? It’s FANTASTIC!! and free.

http://share.robinhood.com/jessel171

Shawn @ NMI

Thanks for stopping by Jesse!

I don’t typically carry a high balance like what I have right now, and my focus has been trying to pay it down, but I admit that sometimes I can get greedy. You know how they say to pay yourself first before anyone else? Well, I think I’m over paying myself! I just love seeing that asset tracker go up in Personal Capital! 😀

Since I have quite a bit invested right now, I’m going to focus on getting that debt back down.

I did use Robinhood recently for a couple weeks but I ended up taking my money out so I could invest it in cryptocurrency. I may come back to it if there are some individual stocks that catch my interest, but I definitely think it’s a cool app – it makes trading easy and is (as you said) FREE!

My only complaint is that I wish you could access it on a desktop, but that’s the only reason they’re able to offer their no-fee programs I’m sure.

Thanks for commenting!

Raman K

Hi Shawn,

I enjoyed reading this piece on your blog! Kudos to you to start saving. As they say it is better late than never! I see that you have some money invested in Ether through coinbase. I have some in Ether and Litecoin through coinbase as well as I see that technology catching up and becoming mainstream sometime in the near future. Keep up the good work!

Cheers

Raman